by

Elizabeth Moran | Feb 10, 2014

Investors know that size counts. Bigger companies with higher net asset values and diversified income streams are lower risk than smaller companies concentrated in just one product and geographical segment. Just as investors favour diversified companies like Wesfarmers because of its range of investments (retail, coal, insurance, chemicals and energy) it’s important to diversify your portfolio across asset classes to protect it from shocks. Diversification aids stability.

While I’ve been writing about fixed income and in particular, bonds for some months, few investors appreciate the size of the market. The fixed income asset class covers a broad range of investments that mostly have known returns although many investments do not have “fixed returns” (for example floating rate and inflation linked bonds) so the name “fixed income” can be a little misleading. Fix income encompasses: deposits, bonds, hybrids and various types of asset-backed securities. So bonds are actually a sub-class within the broader fixed income definition. Generally cash or deposits are listed on a stand-alone basis, which given its importance and size ($1,668.52bn as at 31 December 2013) is understandable.

Discounting cash, the remainder of the Australian fixed income asset class is estimated at $988bn as at 31 December 2013. To put the number in context, the ASX top 100 companies by market capitalisation were worth $1,531bn at the same date.

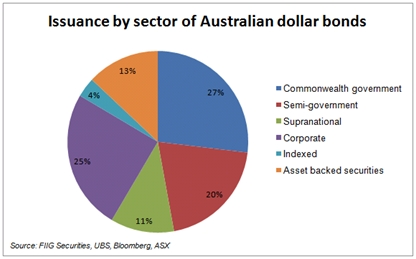

By far, the largest single bond issuer is the Commonwealth government, which had $265.88bn in outstanding fixed rate bonds and $21.67bn in index linked or inflation linked bonds as at 31 December 2013 (see Figure 1). Combined, the state governments and territories had $199.90bn in outstanding bonds. Corporations were another large segment with $247.36bn in fixed and floating rate bonds as well as an additional $4.91bn issued in inflation linked bonds.

Asset backed securities, where there are specific assets that provide security to bondholders, is once again a growing segment, as investor confidence and demand has recovered after the global financial crisis. Approximately 80 per cent of the total $128.3bn on issue was residential and commercial mortgage backed securities. Banks and finance companies pool mortgages and then split them into different classes, much the same way as a capital structure diagram, where those in the highest ranked class sit at the top of the structure and principal is returned to them first; then when they are repaid in full, the second class begins to be repaid, and so on. Investors receive regular interest throughout the life of the security. Those in the lowest class take on equity like risk but are paid higher returns to compensate.

New bond issuance in the wholesale, over-the-counter domestic market in 2013 was $79.5bn, a little less than the A$87.4bn issued in 2012. However, the availability of very cheap funding in the US meant that Australian companies preferred that market and issued US$101.59bn (US$116.82bn in 2012) in public and private placement deals.

Issuance in the smaller ASX market (total value of bonds issued $40.54bn excluding Commonwealth government securities at year end 2013) was $8.4bn, consisting of seven financial institution issues and one corporate issue.

A robust investment portfolio will be diversified across asset classes, industrial sectors, issuers and over different geographical segments. The size to the Australian bond market and the certainty and additional returns bonds provide over cash make it worth investigating.

Figure 1