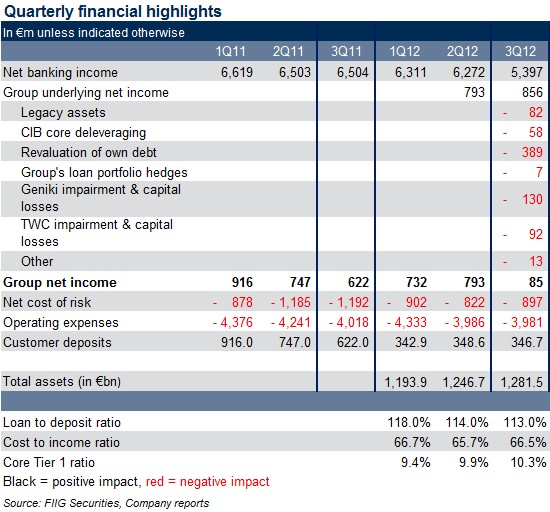

Societe Generale (SocGen) reported its 3Q12 results last week. The Group reported a net banking income of €5.4bn, a 17% decrease compared to €6.5bn in 3Q11. The Group’s net reported income totalled €85m, a whopping 86.3% decrease compared to €622m in 3Q11. On the underlying basis, stripping out non-recurring and non-economic items, SocGen reported net income of €856m (see Table 1), an increase of 8% compared to €793m in 2Q12. It is arguably a better indicator of the Group’s performance, as the extraordinary items, in particular losses on own debt valuation when credit spreads contract, tend to mask otherwise solid performance. In 3Q12, non-recurring items included: €82m negative impact by legacy asset portfolios, €389m loss on own debt valuation, €130m capital loss on the disposal of Geniki Bank subsidiary, €92m loss on sale of US asset manager TCW to Carlyle Group (closing of sale expected in 1Q13) and €58m loss on Corporate and Investment Banking division core deleveraging.

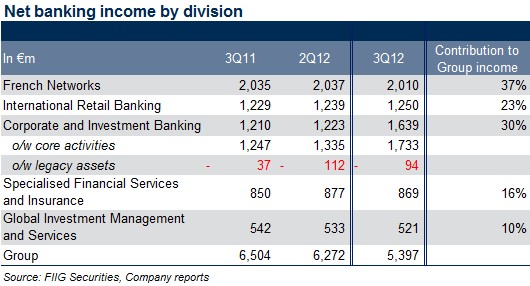

On a divisional basis, French Networks reported a net banking income of €2.01bn (37% of the Group’s net banking income), a marginal decrease of 1.2% over €2.03bn in 3Q11 (see Table 2). Overall, the division results have been stable, a positive sign considering that “French economy has slowed to a crawl”. International Retail banking is also showing resilience, reporting €1.3bn income (up 1.7% from €1.2bn in 3Q12); the division showed strengthening activity in the Mediterranean Basin, Africa and Russia (after 2Q12 goodwill write-down on Rosbank). Corporate and Investment Banking delivered outstanding result of €1.6bn 3Q12 (35.5% jump compared to €1.2bn in 3Q11) on the back of restored investor confidence throughout the quarter. On the other hand, such jumps in earnings signal the volatility inherent in investment banking.

Table 1

Other key points to note:

- Operating expenses were down 0.9% and 0.1% compared to 3Q11 and 2Q12 respectively as a result of continuous efforts to implement new cost management policies

- Net cost of risk (impairment charges) amounted to €897m, down 24.7% versus €1.2bn in 3Q11, but up 9.1% from €822m in previous quarter, mainly due to increase of cost of risk in CIB (with €83m corresponding to an old litigation issue in Australia)

- Loan to deposit ratio continued its downward trend, reducing by 1% to 113%, versus 114% in 2Q12

- Liquid asset buffer stands at €142bn as at 30 September 2012 and is sufficient to cover 100% of short term funding needs (as opposed to only 73% in December 2011). SocGen also changed the composition of the buffer, with €73bn or 51% held in deposits with central banks (versus 40% in 2Q12)

- The balance sheet structure continued to strengthen, with the surplus of stable sources of funds (€53bn in equity, €347bn in customer deposits and €144bn in medium to long term funding) over long term uses of funds (€17bn long term assets, €393bn customer loans and €66bn securities) increasing to €67bn (versus €22bn in December 2011)

- SocGen has issued €20bn (as at 29 October 2012) of new debt throughout 2012 (versus €10-15bn initial program) with average maturity of 6.6 years. The Group is planning to continue issuing in 2012, depending on market opportunities

- In line with the company’s deleveraging strategy, the legacy assets’ portfolio in CIB were reduced by a further €5.4bn from July to October (€5.0bn disposals and €0.4bn amortisation), which had a negative impact of €94m to 3Q12 divisional and group revenues. The program has now come to an end, with €16bn of assets or 2/3 sold since June 2011

- Capital ratios strengthened further, mainly through income generation (+16bps), CIB deleveraging and legacy asset sales (+18bps in 3Q12). The Core Tier 1 (under Basel 2.5) ratio was 10.3% (versus 9.9% in 2Q12). The Group does not calculate fully loaded Basel III, but the management indicated that with current programs in place it will achieve its target of 9.0-9.5% by end 2013

- Banking book sovereign exposure to PIIGS was €2.1bn, or 0.16% of total assets, of which SogGen has zero banking book exposure to Greece

Table 2

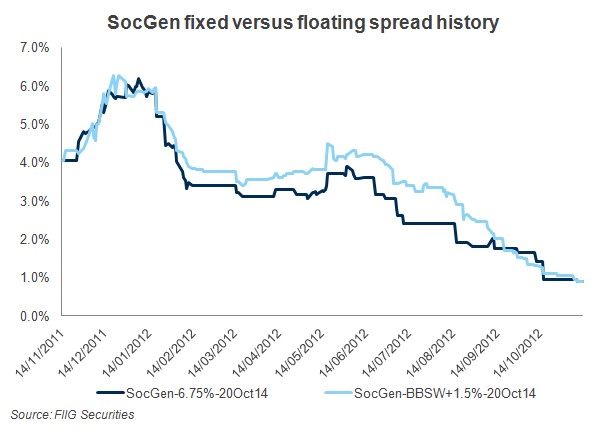

SocGen has AUD fixed and floating senior bond maturing in October 2014 offering circa 3.90% yield. The spreads have rallied since our last update, contracting some 150bps for fixed and 240bps for floating notes (see Figure 1).

All prices and yields are a guide only and subject to market availability. FIIG does not make a market in these securities.