(The following is trading desk commentary and is not to be considered Research)

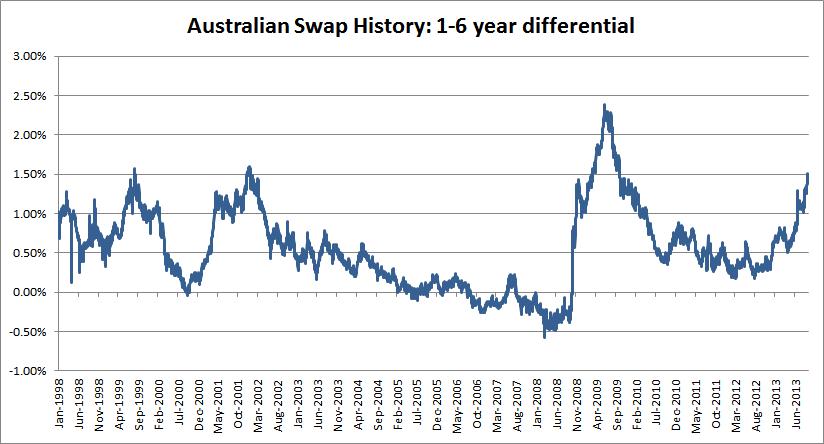

Australia is currently experiencing one of the steepest yield curves in all the major global economies and the steepest since the emergence from the Global Financial Crisis. This is particularly pronounced in the one year to six year sector, where the differential reached a high this week of around 150 basis points (1.50%).

Steepness in the yield curve generally indicates a market expectation that interest rates are due to rise dramatically over the medium term. This is certainly the expectation in the US currently, as employment continues to improve and talk of Quantitative Easing (QE) tapering strengthens. However, in Australia the case for a strengthening economy is much less certain. Inflation continues to emerge below the RBA target of 2.5% and employment (as measured by the ABS Labor Force Employment Change) has shrunk for 3 out of the past 4 months. Any scenario that implies a need for significantly higher interest rates in Australia appears highly unlikely at this point.

The last two occurrences of a yield curve this steep were in the recovery periods following the “tech wreck” of 2000-2001 and the Global Financial Crisis of 2008. The peaks reached for the one and six year spread over these two periods were around 160 basis points and 239 basis points respectively. What differentiates the current scenario is that we are not emerging from a period of crisis, nor is there currently any indication that inflation is looming on the horizon. As is evidenced by the chart below, peaks in yield curve steepness tend to reverse quickly, suggesting that this opportunity could be short-lived.

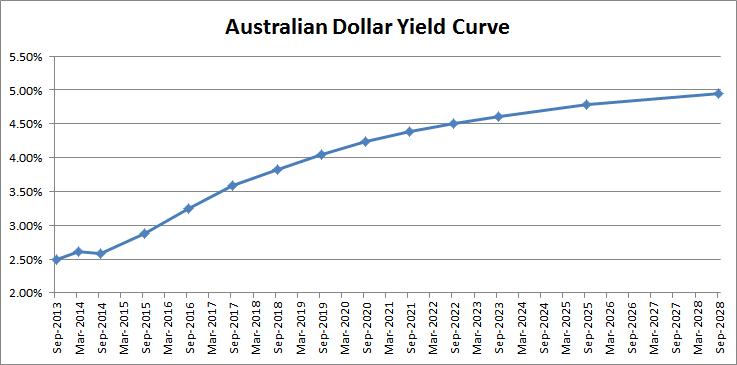

Moreover, with outright short-dated rates at historic lows, the outright interest rate earned on term deposits and floating rate securities is likely to be limited over the medium term. It is our view that the timing is appropriate to extend duration into the six to eight year sector of the yield curve.

As a result, we are currently recommending clients review their portfolios for any securities that are due to mature in two years or less, and look to switch these securities into fixed rate bonds with maturities between six and eight years. If any of the assets in your portfolio meet these criteria, you may expect a communication from us soon with a recommendation that extends duration to that targeted part of the curve while matching (or improving) the credit quality of your investment.

However given trade ideas are time critical please feel free to contact your FIIG representative immediately if you would like to take advantage of this opportunity or would like more information.