by

Ekaterina Skulskaya | Aug 19, 2014

Key points:

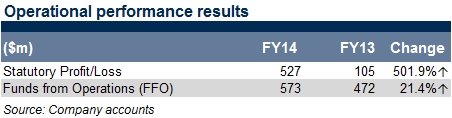

- Statutory profit was $527m for FY14, compared with a $105m loss in FY13. Funds From Operations (FFO) were up by 21.4% to $573m from $472m in FY13.

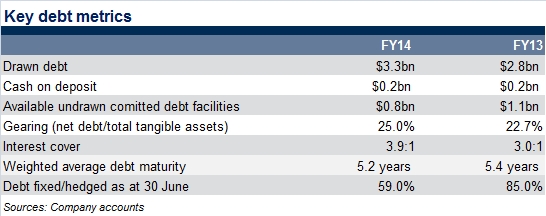

- Unadjusted gearing was up to 25% compared to 22.7% in FY13 and within Stockland’s target range of 20-30%.

- Improvements in the residential market support a positive outlook.

Last week Stockland reported its FY14 results, headlined by an increase in underlying profit for the year ended 30 June 2014 to $555m from $495m in FY13 (see Table 1). Gearing was up to 25% compared to 22.7% in FY13 but remains within Stockland’s target range of 20-30% (see Table 2). The weighted average debt maturity contracted from 5.4 years to 5.2 years. Chief Financial Officer, Tiernan O’Rourke commented: “Our gearing remains comfortably within our target range of 20-30% and we have diverse and long dated debt, which supports the business’s strategy”. Stockland continued to implement its growth strategy with $390m of asset acquisitions and substantial investment in core projects.

Table 1

Table 2

Residential operating profit rose 57.2% to $95m on FY14. The Residential team achieved 5,219 lot settlements for the year and started FY15 with a record 3,185 contracts on hand. The solid results reflect the company’s efficiency improvements; the reshaping of the Residential portfolio and improvement in the residential market with EBIT of $244m at the end of 2014.

The Commercial property business was up 9.9% to $369m with a strong performance from its recently redeveloped centres and the benefits of Stockland’s active re-mixing of tenants within existing centres. The $460m of redevelopments underway continue to progress well and are expected to deliver an incremental internal rate of return (IRR’s) of 12-14%. According to Stockland, the first stage of the Hervey Bay redevelopment opened in July with an overwhelming response from local shoppers. The company’s commercial property CEO, John Schroder commented: “Retail sales have improved over the year. Despite some uncertainty around the Federal budget, and warmer winter weather, we have seen a steady improvement in sales results, with our strongest specialty sales growth achieved in the June quarter”.

The Office division’s underlying Funds From Operations dropped 16.5% to $85m in FY14, reflecting asset sales and soft market conditions. The Retirement business delivered strong operating results with operating profit up 13.8% on FY13 to $40m mainly due to an increase in established unit turnover of 18.3% over the previous year.

From a relative value perspective, the 2020 bonds generate a high income of 6.87% and have a yield to maturity of 4.52%. They are available to retail and wholesale clients from $10,000 and remain one of our favourite bonds. Please speak to your FIIG representative if you are interested in the bonds.

All prices and yields are a guide only and subject to market availability. FIIG does not make a market in these securities. Stockland bonds are available to wholesale and retail investors.

Copyright The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced or distributed to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights.

Disclaimer Certain statements contained in the information may be statements of future expectations and other forward-looking statements. These statements involve subjective judgement and analysis and may be based on third party sources and are subject to significant known and unknown uncertainties, risks and contingencies outside the control of the company which may cause actual results to vary materially from those expressed or implied by these forward looking statements. Forward-looking statements contained in the information regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. Opinions expressed are present opinions only and are subject to change without further notice.

No representation or warranty is given as to the accuracy or completeness of the information contained herein. There is no obligation to update, modify or amend the information or to otherwise notify the recipient if information, opinion, projection, forward-looking statement, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

FIIG shall not have any liability, contingent or otherwise, to any user of the information or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the information. In no event will FIIG be liable for any special, indirect, incidental or consequential damages which may be incurred or experienced on account of the user using information even if it has been advised of the possibility of such damages.

FIIG provides general financial product advice only. As a result, this document, and any information or advice, has been provided by FIIG without taking account of your objectives, financial situation and needs. Because of this, you should, before acting on any advice from FIIG, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If this document, or any advice, relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a product disclosure statement relating to the product and consider the statement before making any decision about whether to acquire the product. Neither FIIG, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice. Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). FIIG strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. FIIG does not make a market in the securities or products that may be referred to in this document. A copy of FIIG’s current Financial Services Guide is available at www.fiig.com.au/fsg.

An investment in notes or corporate bonds should not be compared to a bank deposit. Notes and corporate bonds have a greater risk of loss of some or all of an investor’s capital when compared to bank deposits. Past performance of any product described on any communication from FIIG is not a reliable indication of future performance. Forecasts contained in this document are predictive in character and based on assumptions such as a 2.5% p.a. assumed rate of inflation, foreign exchange rates or forward interest rate curves generally available at the time and no reliance should be placed on the accuracy of any forecast information. The actual results may differ substantially from the forecasts and are subject to change without further notice. FIIG is not licensed to provide foreign exchange hedging or deal in foreign exchange contracts services. The information in this document is strictly confidential. If you are not the intended recipient of the information contained in this document, you may not disclose or use the information in any way. No liability is accepted for any unauthorised use of the information contained in this document. FIIG is the owner of the copyright material in this document unless otherwise specified.

The FIIG research analyst certifies that any views expressed in this document accurately reflect their views about the companies and financial products referred to in this document and that their remuneration is not directly or indirectly related to the views of the research analyst. This document is not available for distribution outside Australia and New Zealand and may not be passed on to any third party without the prior written consent of FIIG. FIIG, its directors and employees and related parties may have an interest in the company and any securities issued by the company and earn fees or revenue in relation to dealing in those securities.