Predicting the future is fraught with danger because of the world’s complexity and randomness. This holds true regardless of how intelligent or well-resourced a person may be.

In 2014, as with every year before, we saw many asset classes achieve returns that were wholly unexpected by forecasters. This highlights a central truth of investing, that in most cases long-term returns are maximised by making your portfolio robust and diverse rather than trying to pick future events.

This was most recently illustrated on the 15th of January, when the Swiss National Bank sent parts of the financial world into chaos with its decision to remove the cap on the Swiss currency's exchange rate with the euro. The surprise decision cost investment banks hundreds of millions of dollars and pushed some currency brokers and hedge funds to the wall. At one point, the Swiss franc appreciated more than 40% against the euro.

2015 is not yet a month old and already we have had this major event that wasn't predicted by anyone. Not one of the hundreds of market commentators providing their annual December forecasts saw it coming. Closer to home, another prime example of uncertainty is the RBA’s monthly interest rate decision including its direction, magnitude and timing. Westpac’s Bill Evans is predicting back-to-back cuts in February and March (after previously forecasting that the next move was up). ANZ, NAB, Deutsche, Macquarie, and Goldman Sachs are also predicting a 2% cash rate by year end after likewise turning 180 degrees from claims the easing cycle was over. There are also many analysts who believe the RBA will not budge this year (CBA, Citibank and Merrill Lynch) and others who forecast a rate hike (Barclays, TD Securities, HSBC, JP Morgan and QIC).

With so many failed forecasts why even bother? In defence of the forecasters, it certainly isn't a lack of intelligence or experience. It is simply the nature of a complex world. Complexity makes for a system that is unpredictable.

As investors, we are much better off focusing on how we can protect our portfolios from any future event instead of trying to predict which one will come our way. The key is to recognise that the future is unpredictable, that random events are going to happen, and to build an investment portfolio that is robust enough to withstand the randomness.

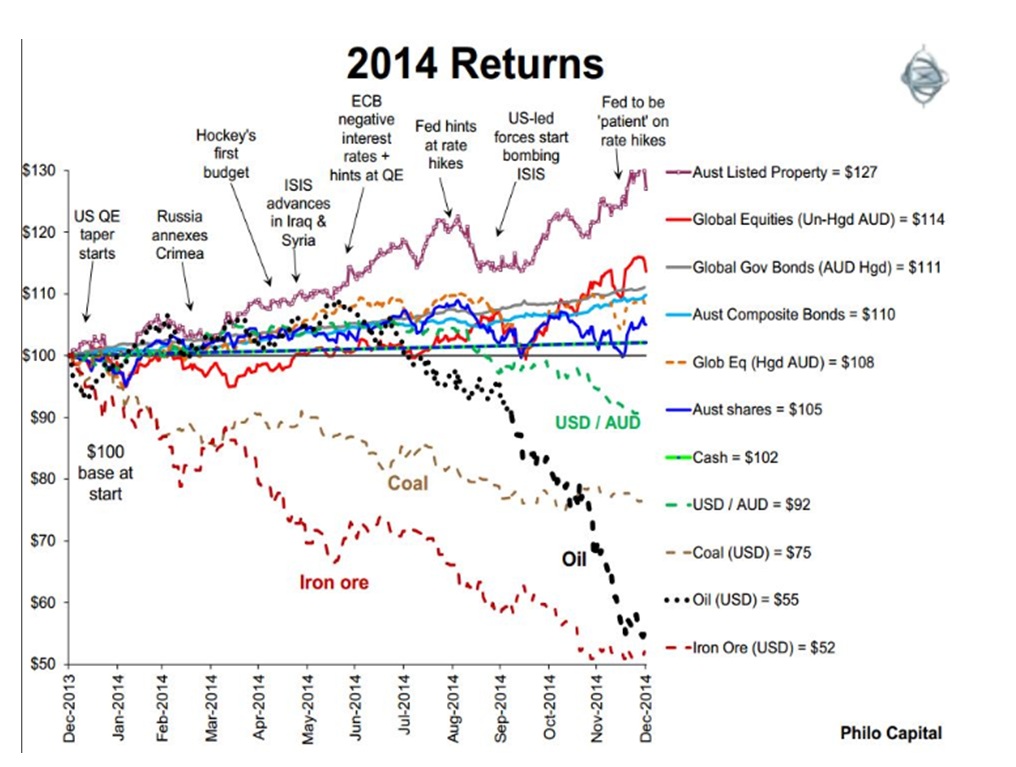

Take for example asset class returns for 2014. The winners and losers were surprising, especially given the commentary at this time last year. At the start of 2014 there was a chorus of economic commentators calling on investors to sell government bonds as they reasoned that the US Fed had to start raising interest rates in 2014. Those rate rises didn’t happen. In fact, economic conditions in some economies deteriorated and global government bond yields contracted and prices of the bonds rose.

This meant that Global Government Bonds (AUD hedged) were the third best performing asset class for 2014, with Australian Composite Bonds (the Composite Bond Index comprises approximately 70% government bonds) coming a close fourth, up 11% and 10% respectively. While not shown in the graph below, unhedged Global Government Bonds would have been the second top performer if currency appreciation was included. Australian shares had a relatively poor year with a 5% increase according to Philo Capital, as shown in the graph below.

Those heavily exposed to oil/energy companies would have been hammered with the unexpected precipitous decline in oil and resources prices, while those exiting government bonds given the expectation of interest rate rises missed out on some of the highest returns.

All of this goes to show that we cannot predict the future regardless of how intelligent, experienced, or well-resourced we are. This is why portfolio diversification - across industry, capital structure, bond type, currency and many other factors - is an indispensable strategy for investors.

Please refer to Elizabeth Moran’s article Best bonds right now for individual investment ideas.

Copyright The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced or distributed to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights.

Disclaimer Certain statements contained in the information may be statements of future expectations and other forward-looking statements. These statements involve subjective judgement and analysis and may be based on third party sources and are subject to significant known and unknown uncertainties, risks and contingencies outside the control of the company which may cause actual results to vary materially from those expressed or implied by these forward looking statements. Forward-looking statements contained in the information regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. Opinions expressed are present opinions only and are subject to change without further notice.

No representation or warranty is given as to the accuracy or completeness of the information contained herein. There is no obligation to update, modify or amend the information or to otherwise notify the recipient if information, opinion, projection, forward-looking statement, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

FIIG shall not have any liability, contingent or otherwise, to any user of the information or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the information. In no event will FIIG be liable for any special, indirect, incidental or consequential damages which may be incurred or experienced on account of the user using information even if it has been advised of the possibility of such damages.

FIIG provides general financial product advice only. As a result, this document, and any information or advice, has been provided by FIIG without taking account of your objectives, financial situation and needs. Because of this, you should, before acting on any advice from FIIG, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If this document, or any advice, relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a product disclosure statement relating to the product and consider the statement before making any decision about whether to acquire the product. Neither FIIG, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice. Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). FIIG strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. FIIG does not make a market in the securities or products that may be referred to in this document. A copy of FIIG’s current Financial Services Guide is available at www.fiig.com.au/fsg.

An investment in notes or corporate bonds should not be compared to a bank deposit. Notes and corporate bonds have a greater risk of loss of some or all of an investor’s capital when compared to bank deposits. Past performance of any product described on any communication from FIIG is not a reliable indication of future performance. Forecasts contained in this document are predictive in character and based on assumptions such as a 2.5% p.a. assumed rate of inflation, foreign exchange rates or forward interest rate curves generally available at the time and no reliance should be placed on the accuracy of any forecast information. The actual results may differ substantially from the forecasts and are subject to change without further notice. FIIG is not licensed to provide foreign exchange hedging or deal in foreign exchange contracts services. The information in this document is strictly confidential. If you are not the intended recipient of the information contained in this document, you may not disclose or use the information in any way. No liability is accepted for any unauthorised use of the information contained in this document. FIIG is the owner of the copyright material in this document unless otherwise specified.

The FIIG research analyst certifies that any views expressed in this document accurately reflect their views about the companies and financial products referred to in this document and that their remuneration is not directly or indirectly related to the views of the research analyst. This document is not available for distribution outside Australia and New Zealand and may not be passed on to any third party without the prior written consent of FIIG. FIIG, its directors and employees and related parties may have an interest in the company and any securities issued by the company and earn fees or revenue in relation to dealing in those securities.