by

Justin McCarthy | May 13, 2014

Key points:

- Swiss Re reported another strong quarterly result. While 1Q14 NPAT was down 11.1% to US$1.2bn the solvency ratio improved to 241% compared to 229% in 3Q13.

- Existing holders should assess their holding period returns and consider taking profits.

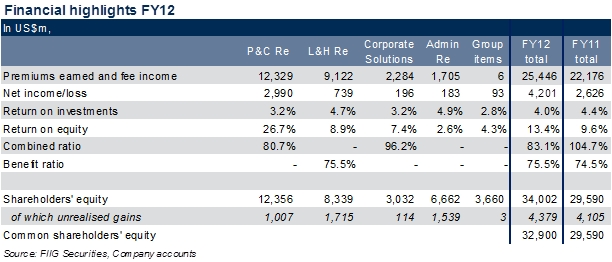

Swiss Re reported their 1Q14 results (to 31 March 2014) last week with a very healthy net profit after tax (NPAT) of US$1.2bn for the quarter on the back of another impressive contribution from the Property and Casualty Reinsurance segment, strong volumes (offsetting challenging prices), low natural catastrophe occurrence and solid investment returns.

Shareholder’s equity, rose yet again by 6% to US$35bn (US$33bn), as did the Swiss Solvency Test (SST) ratio, to 241% versus 229% in 3Q13; both reinforcing the high capital base of Swiss Re.

Highlights included:

- NPAT US$1.2bn (down 11.1% from 1Q13) for the quarter producing a return on equity of 14.9% (down 10.3%)

- P&C Reinsurance contribution was down marginally to US$1.0bn but the combined ratio was up 13% to 78.8%, due to: a strong underwriting result including reserve releases, realised gains on investments and favourable tax impacts. Premiums earned during the first quarter rose by 7.9% to US$3.8bn, mainly driven by the expiry of a major quota share agreement.

- Life & Health Reinsurance net income was US$51m, down 77%. The result was impacted by a loss on an interest rate hedge. Premiums earned and fee income were 15.5% higher at US$ 2.7bn, largely due to significant new business in Asia and Europe as well as recaptured business.

- Corporate Solutions net income of US$80m was down 21% over 1Q13, while premium growth showed a healthy 35.4% increase to US$830m

- Swiss Re’s capital position remains strong with shareholders' equity of US$35bn (US$32bn 1Q13) and Group SST ratio of 241%

- Admin Re Reinsurance net income of US$48m and gross cash generation of US$202m

Swiss Re remains on track to reach its 2011-2015 financial targets. The Group’s Chief Executive Officer, Michael M. Lies commented:

“I'm pleased with the first quarter performance of our Group. P&C Re had another remarkable quarter. L&H Re wrote significant profitable new business, and while the US GAAP result is below expectations, we are making good progress in strengthening the underlying business. Corporate Solutions continued growing profitably in the quarter and Admin Re® has become a solid and steady cash generator for the Group. I'm confident that all segments will contribute to achieving our 2011—2015 financial targets."

Conclusion

While the credit quality remains very strong, we continue to believe that the Swiss Re Tier 1 hybrids are fully priced.

Existing investors may wish to assess their holding period returns and consider taking some profits in light of the very strong performance over recent years (as demonstrated by the charts below).

On the other hand any wholesale clients who do not hold an exposure to Swiss Re should consider doing so as it provides access to a very strong, global company that can add diversity to existing portfolios. However the yield to expected maturity (in May 2017) of 5.37% for the floater and 5.49% for the fixed is unlikely to provide upside in the next three years until first call.

Swiss Re Tier 1 securities are only available to wholesale investors with minimum parcel sizes of $100,000. For further information and research on Swiss Re please contact your dealer. Yields quoted are as at 12 May 2014 and subject to change.