by

Justin McCarthy | Nov 14, 2012

Swiss Re reported their 3Q12 results on 8 November producing another cracking result with net profit of US$2.2bn beating consensus estimates of US$1.35bn by more than 60%. The result was up almost 70% on 3Q11 net profit of US$1.3bn. The two key contributors were a benign period of natural catastrophes (although Hurricane Sandy will impact the 4Q12 result) and an extraordinary gain from the sale of Admin Re’s US business.

Highlights of the 3Q12 result were as follows:

- Net profit after tax US$2.2bn (versus consensus estimates of US$1.35bn and 3Q11 of US$1.3bn)

- Return on equity of 28%

- Excellent property & casualty reinsurance combined ratio of 69.3% (anything below 100% represents profitable operations and the lower the better). Overall group combined ratio was just 72% (versus 85.3% in 3Q11)

- Premiums earned and fee income grew 11% to US$6.6bn (versus 3Q11 US$5.9bn)

- Shareholder’s equity up a significant US$2.5bn for the quarter to US$33.5bn

- The investment portfolio continues to perform with investment income for the quarter of US$1.0bn and return on investment of 4.5%. Significant unrealised gains also exist, mainly from high quality fixed income assets that have risen in value as yields/interest rates fall

- Total PIIGS direct investment of just US$37m (out of total assets of US$225bn)

- 3Q12 profit boosted by US$626m gain on sale of Admin Re’s US business REALIC (somewhat reversing the loss on sale of US$1,025m taken in 2Q12)

- Swiss Re Group Swiss solvency ratio a very healthy 207%

- Management stated that it is too early to give estimate for Hurricane Sandy claims

There was one negative aspect of the result however. As we have previously highlighted, Swiss Re is operating with very high levels of capital. And one of the risks is that management will look to return some of that excess capital to shareholders by way of special dividends, share buybacks etc. For the first time since the GFC, the company have acknowledged that this is possible and in their results release stated there is “the possibility of a special dividend to address excess capital”. While such action is only possible due to the excess capital it nonetheless will reduce the buffer below debt holders. However, it is not expected to have a material impact on the credit risk of Swiss Re’s Tier 1 hybrids.

Swiss Re management reported that everything was on track and they remain well-placed to achieve their five-year financial targets. Whilst they were not yet in a position to estimate the impact of Hurricane Sandy, they did not make any amendments to full year profit guidance suggesting the impact will be manageable. Our rough estimate of likely net losses is in the range of US$200m-US$700m, but even at the higher end this is more than manageable.

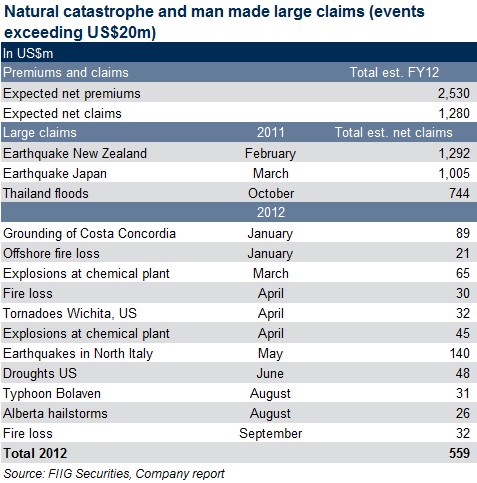

The following table sets out the reinsurance claims for the first three quarters of 2012 as well as the large claims sustained in 2011.

Note that Swiss Re budgeted for payouts of US$1.28bn in FY12 versus actual payout in the first three quarters of just US$559m, leaving US$721m provisioned for 4Q12. Moreover, net premiums received totalled US$2.53bn providing plenty of room for payouts and the reinsurance operation to remain profitable.

The low claims made in 2012 and 3Q12 in particular are a key reason for the strong results.

Relative value of Swiss Re versus AXA Tier 1 hybrids

Against the backdrop of an excellent result for Swiss Re we have undertaken an analysis of the relative value between the Swiss re and AXA Tier 1 hybrids in A$.

Swiss Re is considered to be a significantly stronger credit that AXA at present for a number of key reasons:

- Capital - Swiss Re holds materially higher capital levels to allow for unpredictable natural catastrophe payouts and to attain a higher credit rating which is crucial for reinsurers. AXA with a less volatile business lines (life, health, property and casualty insurance and wealth management) can hold less capital and a high credit rating is not as important to obtaining retail business.

- Investment portfolio risk - Swiss Re has negligible exposure to PIIGS, less investment in Europe and overweight holdings of US Treasuries. Given that around two-thirds of AXA’s operations are centred in Europe, it has significantly more direct exposure to European sovereign and bank debt, including material positions in Italian and Spanish Government bonds. It also has relatively low holdings of US Treasuries versus a large holding of French Government bonds.

- Overall risk to Europe – Swiss Re has around a third of its insurance risk located in each of the three regions US, Asia and Europe. Its greatest risk is housed in US hurricane reinsurance. Combined with the relatively lower exposure to European investments, Swiss Re is considered to be one of the better European insurers/reinsurers when it comes to facing a downturn or disaster in Europe. AXA on the other hand has around two-thirds of its insurance operations and hence risk in the region plus a materially higher proportion of its investments linked to Europe. In summary, AXA is more exposed to a prolonged downturn or moreover crash in European investment markets. (Note that our base case is for Europe to not “crash” but rather to muddle though over a prolonged period of low growth).

As a consequence of the above, Swiss Re’s Tier 1 hybrids are rated 3 notches higher by Standard and Poor’s than AXA’s Tier 1 hybrids. Further, the rating trajectory on AXA is downwards whereas Swiss Re is stable or even positive.

As the credit analyst that covers both of these securities, I believe the Swiss Re is a far superior credit (as long as Europe remains in a state of heightened risk, which we expect to persist for many years and Swiss Re does not get an inordinate amount of natural catastrophe payouts in a short period).

The higher the credit risk, the higher the call risk as well. While we continue to expect both will be called at first opportunity (subject to regulatory approval and market conditions at that time), it is fair to assume that AXA is more likely to be in a position that could see a large loss and/or strained capital position result in either the regulator or management delaying any call.

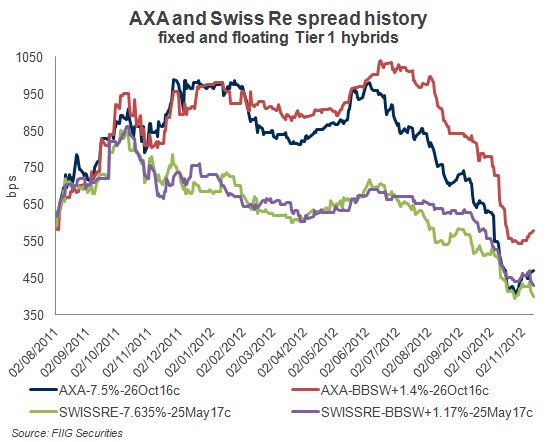

Despite the credit risk difference, the market is not pricing in a significant difference between the A$ AXA and Swiss Re Tier 1hybrids, as demonstrated by the chart below which plots the credit spread to call date for each.

In particular, there is very little difference between the AXA fixed rate securities and the Swiss Re fixed and floating. The AXA floater does, however, trade at a considerably higher credit margin.

The question is what should the differential be?

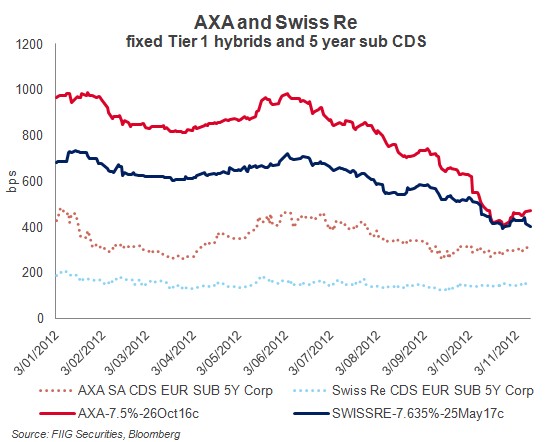

The following chart plots the five year subordinated credit default swap (CDS) margin for AXA and Swiss Re and the credit margin for the A$ AXA and Swiss Re fixed rate Tier 1 hybrids. Note that the CDS is a synthetic proxy for subordinated debt credit margin and does not include call risk. The Tier 1 hybrids are further down the capital structure and include call risk and as such the credit margins are wider to compensate for that risk.

Despite the fact that Swiss Re subordinated CDS has remained circa 150bp – 250bp tighter than AXA for the majority of 2012 (currently the difference is 150bp), the difference between the two cash securities has rapidly reduced in the last few months from around 250bp – 300bp to the point that the AXA Tier 1 hybrid is just 70bp wider than Swiss Re for the fixed rate securities (and was almost the same level just a few weeks back).

As you move down the capital structure, the differential should increase, not decrease as the differences in credit (and call) risk are magnified.

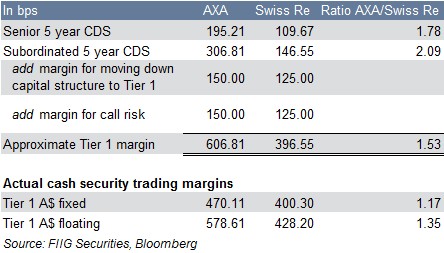

The following table seeks to approximate where we believe the difference should be using some very broad estimates of additional risk for moving further down the capital structure and taking on call risk. The starting point is five year senior and subordinate CDS for both companies which indicate the CDS market at least places a higher risk premium on AXA.

Given the higher risk assessment on AXA over Swiss Re, we have assumed a greater additional credit margin for both the credit risk of moving to Tier 1 level (AXA +150bp versus Swiss Re +125bp) and call risk (AXA +150bp versus Swiss Re +125bp), although it could be argued the 25bp differential on each is relatively small given the three notch differential in credit rating.

Based on this simplistic analysis there should be approximately 210bp difference between the Swiss Re and AXA Tier 1 hybrids in our view, or at the very least 150bp if you take the same additional margin for increased credit risk and call risk from moving down into the Tier 1 category. Whilst the first call date of AXA is seven months earlier we do not believe this would have any meaningful impact on the analysis above.

There are a number of observations from the table and charts above:

- AXA fixed in particular has run too far, relative to Swiss Re, and could be argued is very fully priced. The A$ Tier 1 trades at significantly tighter margins than similar AXA Tier 1 hybrids in other currencies which supports this argument

- Swiss Re still exhibits some value but is close to being fairly priced. This credit margin on Swiss Re’s A$ Tier 1 hybrid is consistent with margins on other Swiss Re subordinate and Tier 1 hybrid securities that trade in other currencies

- AXA has been, and we expect will continue to be, more volatile as sentiment ebbs and flows in Europe

- In a “risk off” environment, it could be expected that AXA will underperform and the credit spread could widen materially, resulting a price fall of as much as $10, whereas the impact on Swiss Re is expected to be much smaller.

Conclusion

Swiss Re (and AXA) continue to produce profitable results, but Swiss Re is clearly a superior credit at present with less exposure to a European downturn. Despite this, the A$ market is pricing in very little difference between the two.

In our view, the AXA fixed rate securities have run too far. Investors may consider lightening off on their AXA exposure, either as a portfolio re-weighting towards less Tier 1/subordinate risk and moving up the capital structure into senior debt, or for those wishing to remain overweight in higher yielding investments (albeit with additional risk), switch into either Swiss Re fixed or floating, or even the AXA floater which trades well behind the theoretical break-even level.

All prices and yields are a guide only and subject to market availability. FIIG does not make a market in these securities.