Profit increased 8.8% in the first half to $1.6bn driven by growth in customers signing up to the 4G network. The mobile business added some 607,000 new mobile customers and posted revenues of $4.56bn (a 4.6% increase). Positively for bondholders the group scraped its dividend commitment during the half.

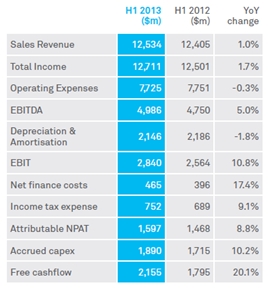

- 1H13 sales increased by 1.0% to $12.53bn and total income increased by 1.7% to $12.71bn

- Operating expenses decreased by 0.3% to $7.72bn. Labour expenses decreased by 6.1% to $2.39bn driven by declining salary and associated costs. This included a $103m reduction due to bond rate movements impacting long service leave and workers compensation provisions. Lower labour substitution and lower contractor and agency costs also contributed to a decline in labour expenses

- Goods and services purchased increased by 0.7% to $3.18bn due to the increased take up of smartphones. Other expenses increased by 5.3% to $2.15bn as the sale of TelstraClear was completed and a loss of $127m mainly arising from the realisation of a foreign exchange loss was recognised

- EBITDA increased by 5.0% to $4.98bn, with EBITDA margins up 1.5 percentage points at 39.8%. EBIT increased by 10.8% to $2.84bn

- Net finance costs increased by 17.4% to $465m arising from valuation impacts on derivative financial assets and liabilities. This was offset by a reduction in average interest cost

- Reported profit after tax increased by 8.8% to $1.59bn

- Free cashflow increased 20% to $2.15bn, including cash proceeds from the sale of TelstraClear of $671m. Excluding proceeds from TelstraClear, free cashflow declined by 17% due to investments in working capital

- Net debt at 1H13 was up $337m to $13.61bn reflecting a decrease in gross debt of $1.02bn offset by a net reduction in cash and cash equivalents of $1.36bn due to what Telstra describe as high financing demands and market uncertainty

- Outlook: Telstra confirmed fiscal 2013 guidance of low single digit total income and EBITDA growth, with free cashflow of between $4.75bn and $5.25bn. Telstra expects capital expenditure to be around 15% of sales

The underlying 1H12 result for Telstra was good. The stable nature of revenues and earnings is reflected in the stability of the Telstra bonds during periods of significant volatility over the last 12 months. While the group announced a 14c interim dividend, the move by management late last year to end it dividend commitment is broadly positive for bondholders.