Goldman Sachs Group (GS) reported NPAT of US$1.45bn 3Q12 compared a loss of US$428m a year earlier.

Investment Banking revenue was US$1.16bn, 49% higher YoY and 3% lower compared 2Q12. Revenues in the firm’s underwriting business were US$655m, more than double the amount in 3Q11 which had particularly low volumes. This increase primarily reflected significantly higher revenues in debt underwriting, principally due to higher net revenues from leveraged finance activity.

Revenues in Institutional Client Services were US$4.18bn, 3% higher than the third quarter of 2011 and 8% higher than the second quarter of 2012. Net revenues in Fixed Income, Currency and Commodities Client Execution were 28% higher at US$2.22bn. This increase reflected significantly higher net revenues in mortgages and higher net revenues in credit products, currencies and interest rate products, partially offset by significantly lower net revenues in commodities.

Equities were 16% lower at US$1.96bn 3Q12 primarily due to significantly lower commissions and fees, reflecting lower market volumes, and lower net revenues in equities client execution. In addition, net revenues in securities services were slightly lower, primarily reflecting the impact of lower average customer balances.

The net loss attributable to the impact of changes in the firm’s own credit spreads was US$370m 3Q12 compared with a net gain of US$450m the prior year.

The company's accrued compensation expenses remained at 44% of revenues - consistent with its quarterly accruals in 2011, and non-compensation costs have declined 10% year to date.

The firm’s Tier 1 capital ratio was 15.0% and the firm’s Tier 1 common ratio was 13.1% both unchanged compared with 2Q12. GS estimates its Basel III Tier 1 common ratio was 8.5% and it anticipates maintaining an approximately 100bps buffer above its regulatory minimum, once those guidelines have been established. Goldman continued its share repurchase activity during the quarter and raised its dividend.

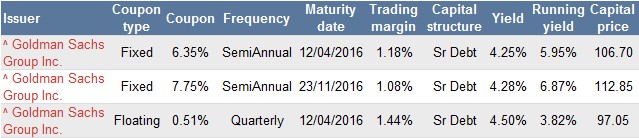

Goldman Sachs bonds are available to wholesale investors with the security of senior debt as detailed in Table 1.

Table 1

For more information please call your local dealer.

All prices and yields are a guide only and subject to market availability. FIIG does not make a market in these securities.