How many times have you heard lately that a “1 in 100 year event” has occurred? Weather events and finance events in particular seem to have occurred far too often in recent times, typically with great consequences for people’s quality of life.

The Global Financial Crisis was described this way – “a five standard deviation event”; “a black swan event”; “once in a generation”. But the fact is that putting odds on this type of event like “1 in 100” is misleading. It suggests that these are predictable events, which they are not, or that they will not occur for another 100 years. That’s why for all the time finance professionals spends talking about risk, 99% of them failed to forecast the GFC. Too much of the industry looks in the rear vision mirror to assess risks – “based on the last 100 years of data, the chances of that event happening are 1 in 100”. They define this rear vision probability based approach as “risk”.

But what if past performance is not indicative of future performance? What if the world has fundamentally changed e.g. due to climate change; or due to more leverage being applied by parts of the finance sector? What if the world’s population in the future is much older than the population in the past and therefore past data is irrelevant?

Looking backwards to define risks is missing a major part of the current and future risk equation. The other part of the risk equation is “uncertainty”.

What is the difference between risk and uncertainty?

Risk is typically defined as the chances of something happening in the future given what we know about the past. Uncertainty is the reality that some outcomes aren’t predictable just by looking at the past. Frank Knight, a relatively unknown economist from the 1920s, described the difference very elegantly.

He was the first economist to break ranks and suggest that assuming certainty was foolish, and that there were two distinct concepts of “risk” and “uncertainty”. His assertion was illustrated by imagining an urn containing marbles, 40 per cent of which are red and 60 per cent are not red. If you draw one marble from the urn, you don’t know what colour the marble will be, but you know that there is a 40% risk that it will be red.

The non-red marbles are yellow and black. You don’t know how many there are of each. So when you are about to draw a marble from the urn, if you were asked what the risk is that it will be black, you have no way of really assessing the probability. It’s not 40 per cent or 60 per cent; it is unknowable. That unknowable is what Frank Knight characterised as uncertainty. And there is a very big difference between risk and uncertainty.

Uncertainty is the most important consideration in investing

Uncertainty must be considered in planning one’s retirement in particular. Once retired, there is typically little chance of being able to earn back any capital lost. Similarly, there is no chance of stopping your spending while you wait for markets to rebound. You either need to have enough certain income, or you will be forced to sell assets during the storm, which is never a good outcome. Uncertainty, more so than risk, poses a significant question to investors: “If no-one can predict the future with any certainty, what can I do to ensure I survive the storm?”.

Many investors decide the best way to survive is to simply invest in term deposits and other cash investments. In fact the average SMSF in Australia today has around 27% of its investment in cash. If we look at “risks”, i.e. looking backward, this seems like a safe strategy. Inflation has been between 2 and 3% for nearly a generation and doesn’t appear to be going anywhere any time soon. But what if inflation did spike like it did in the 1970s? How would your retirement funds survive then?

“The asset class that most investors consider the “safest”—cash—is actually extremely risky.” – Warren Buffett

Obviously Buffett has used “extremely risky” for effect. Cash isn’t extremely risky. But it’s not risk free either, and the risk is inflation. It is not anticipated inflation (2-3%pa), it is the unanticipated inflation that is damaging. What is hard is thinking about how inflation could possibly jump to say 5% or more when it has been so benign for so long.

Investors in 1970 probably felt exactly the same. At that stage, they had seen 18 years of inflation averaging 2-3%. But retirees in 1970 would see 76% of their savings eroded by inflation over the following 13 years (their life expectancy at that time). Economists in 1970 were saying there was a “minor risk of inflation”. But uncertainty was about to impact retirees like never before.

Inflation Risk & Inflation Uncertainty

Economists aren’t predicting a jump in inflation now either, and nor are we. Our expected case scenario is that inflation can be contained in the 2-3% range, with some risk on the upside if the fall in the Australian Dollar pushes up import prices. We can point to that risk because in the past a falling AUD has lead to inflation pressures e.g. due to rising petrol prices.

But there is a new uncertainty at play here – so called quantitative easing. Will global inflation spike as a result of all of the cheap credit that central banks in the US and EU are providing? Five years or more of pumping cheap credit into financial institutions and the economy is unprecedented. Just like predicting the chances of pulling a yellow marble out of the urn, we don’t have any data to use to predict what impact this will have of inflation in the next 10 years. We don’t know what the impact will be, and fact this is “unknowable” because there is not much more than academic theories to help guide us.

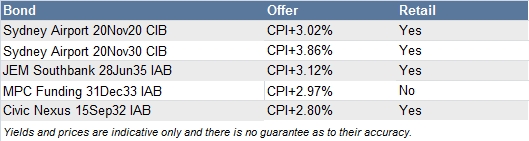

That unknowable risk is what Frank Knight characterised as uncertainty. Given that it is unknowable, all you can do is to consider whether you want to include investments in your portfolio that rise in value and/or income if inflation does suddenly jump. Gold, oil, farmland, infrastructure and inflation-linked bonds are amongst the best inflation hedges (i.e. investments that will go up in value if inflation rises). Australian investors have plenty of options for investing in these assets with many on the ASX, but also through the bond market. We’ve listed a few examples below:

Copyright The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced or distributed to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights.

Disclaimer Certain statements contained in the information may be statements of future expectations and other forward-looking statements. These statements involve subjective judgement and analysis and may be based on third party sources and are subject to significant known and unknown uncertainties, risks and contingencies outside the control of the company which may cause actual results to vary materially from those expressed or implied by these forward looking statements. Forward-looking statements contained in the information regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. Opinions expressed are present opinions only and are subject to change without further notice.

No representation or warranty is given as to the accuracy or completeness of the information contained herein. There is no obligation to update, modify or amend the information or to otherwise notify the recipient if information, opinion, projection, forward-looking statement, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

FIIG shall not have any liability, contingent or otherwise, to any user of the information or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the information. In no event will FIIG be liable for any special, indirect, incidental or consequential damages which may be incurred or experienced on account of the user using information even if it has been advised of the possibility of such damages.

FIIG provides general financial product advice only. As a result, this document, and any information or advice, has been provided by FIIG without taking account of your objectives, financial situation and needs. Because of this, you should, before acting on any advice from FIIG, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If this document, or any advice, relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a product disclosure statement relating to the product and consider the statement before making any decision about whether to acquire the product. Neither FIIG, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice. Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). FIIG strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. FIIG does not make a market in the securities or products that may be referred to in this document. A copy of FIIG’s current Financial Services Guide is available at www.fiig.com.au/fsg.

An investment in notes or corporate bonds should not be compared to a bank deposit. Notes and corporate bonds have a greater risk of loss of some or all of an investor’s capital when compared to bank deposits. Past performance of any product described on any communication from FIIG is not a reliable indication of future performance. Forecasts contained in this document are predictive in character and based on assumptions such as a 2.5% p.a. assumed rate of inflation, foreign exchange rates or forward interest rate curves generally available at the time and no reliance should be placed on the accuracy of any forecast information. The actual results may differ substantially from the forecasts and are subject to change without further notice. FIIG is not licensed to provide foreign exchange hedging or deal in foreign exchange contracts services. The information in this document is strictly confidential. If you are not the intended recipient of the information contained in this document, you may not disclose or use the information in any way. No liability is accepted for any unauthorised use of the information contained in this document. FIIG is the owner of the copyright material in this document unless otherwise specified.

The FIIG research analyst certifies that any views expressed in this document accurately reflect their views about the companies and financial products referred to in this document and that their remuneration is not directly or indirectly related to the views of the research analyst. This document is not available for distribution outside Australia and New Zealand and may not be passed on to any third party without the prior written consent of FIIG. FIIG, its directors and employees and related parties may have an interest in the company and any securities issued by the company and earn fees or revenue in relation to dealing in those securities.