Introduction

The Australian Prudential Regulation Authority (APRA) has released a paper which considers the Basel III capital reforms and their likely impact on the banking system and the economy. Following is a summary of their findings.

In general, more capital in banking institutions means slightly higher lending interest rates, less borrowing, and slower economic growth in good times. However it also means safer banking institutions and a safer financial system, by reducing the risk of bank failures and financial crises. The challenge for regulators is to balance the benefits of safer banking systems, with any output, efficiency or competition costs associated with higher capital requirements.

Costs and benefits

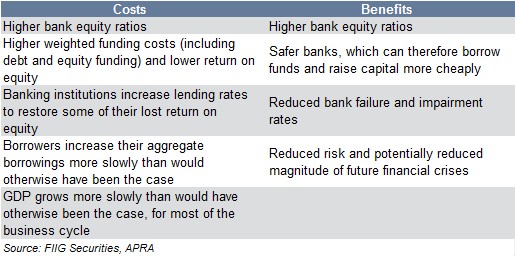

The increase to bank holdings of regulatory common equity Tier 1 capital (CET1) will come with associated costs and benefits as detailed in Table 1.

Table 1

Quantifying the impact

- In order to quantify the impact, APRA has assessed the marginal regulatory capital requirement as the difference between the CET1 ratio a banking institution will target (including a buffer over APRA’s regulatory requirements), compared to the CET1 ratio it would have held to meet its board or (usually) ratings agency constraints, in the absence of Basel III requirements

- In the Australian context, this is the difference between what is held now, about a 7% CET1 ratio, and what will be held by 2016 when the Basel III capital rules are fully in place

- APRA conducts an arithmetic analysis on the basis of a 2% increase in CET1 ratios by the larger banks stating that this increase does not predict likely outcomes but is used to illustrate the broad impact of higher capital requirements

The effect on bank interest rates

- For a 2% increase in the CET1 ratio, the effect on a typical non-housing loan will be no more than 0.10% and for a home loan, no more than 0.04%

- However, there is an offset to these figures from Australia’s banking institutions becoming safer and, accordingly, enjoying lower funding costs, more access to funding and, to some extent, a lower required return on equity. The benefits however are difficult to calculate in the context of any specific banking institution’s cost of equity and cost of funding. APRA suggest a plausible range for both as zero to a few basis points

- New lending rates will increase - however the increase is estimated to be minimal

The effect on total credit and GDP

Higher lending rates and perhaps reduced lending lead to lower aggregate demand, decreasing real GDP. APRA suggest that empirically very small increases in loan pricing can only lead to very small decreases in loan demand, so overall GDP reductions are correspondingly small.

APRA make the following points based on multiple research sources:

- Even substantial increases in bank capital requirements do not produce large increases in lending rates

- Small increases in lending rates will lead to correspondingly small changes in loan demand

- Small decreases in loan demand will lead to very small decreases, over many years, in GDP