by

Elizabeth Moran | Apr 01, 2014

Key points:

- The income on floating rate bonds will rise as expectations of future interest rates rise, thus protecting and improving income in a rising interest rate environment.

- This year has seen four higher yielding floating rate bonds come to the over the counter (OTC) market, providing much needed higher income as well as protecting investors should interest rates rise.

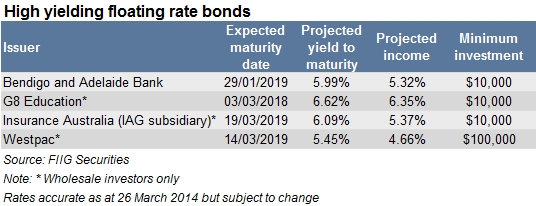

- Bendigo and Adelaide, IAG and Westpac issued subordinated bonds; slightly higher risk than senior debt or senior bonds and as such pay higher returns ranging from a projected yield to maturity of 5.45% for Westpac through to 6.09% for IAG.

- The fourth floater issued this year in the OTC market was the G8 Education senior bond which currently has a higher projected yield to maturity of 6.62%.

Speculation that interest rates may rise in the US is growing after Janet Yellen, Chair of the Board of Governors of the Federal Reserve System, made a Freudian, or perhaps well-choreographed slip, that she expected interest rates to increase in autumn (around September). Higher US interest rates should see a corresponding increase in Commonwealth government bond rates as they tend to move in the same direction as US Treasury yields.

However, there is no certainty that interest rates will rise and global economic signals continue to be mixed.

For some time I’ve been encouraging investors to consider floating rate bonds. The income on these bonds will rise as expectations of future interest rates rise, thus protecting and improving income in a rising interest rate environment. However, floating rate bonds, until recently, have generally offered insufficient income to tempt investors away from fixed rate bonds that have greater certainty and higher income.

This year has seen four higher yielding floating rate bonds come to the over the counter (OTC) market, providing much needed higher income as well as protecting investors should interest rates rise. I doubt interest rates will move lower, the rationale therefore is that the next move is likely to be up, at some future, unspecified date and if you share the same view, it is a good time to consider adding these floating rate bonds to your portfolio.

Bendigo and Adelaide, IAG and Westpac issued subordinated bonds; slightly higher risk than senior debt or senior bonds and as such pay higher returns. In part, the additional risk is that the repayment date expected in five year’s time can be extended if the company chooses not to repay investors at the first opportunity (known as the call date). Final maturity for Bendigo and Adelaide Bank and Westpac bonds is in ten years. In Australia, major banks have always repaid at the first call date, giving investors confidence the majors are likely to keep repaying at the first opportunity. Consequently, the Westpac bond has the lowest projected yield to maturity of 5.45%

The IAG bond (in fact issued by its fully owned subsidiary Insurance Australia Limited) is more complex than the two bank issues, and has a much longer term to final maturity of 26 years. Investors need to keep in mind the potential for a longer term to maturity however IAG investors can elect to convert to $101 of equity at any time after year eight, giving them an early exit if needed.

The fourth floater issued this year in the OTC market was the G8 Education senior bond which currently has a higher projected yield to maturity of 6.62%, the highest amongst this group. The senior status of this bond means capital must be repaid at maturity in approximately four year’s time. The G8 bond is callable at $103 after two years and $101.50 after three years, again at the discretion of the company.

Interest payments must be made on the Bendigo and Adelaide Bank, G8 Education and Westpac bonds; there is no option to defer or skip. The IAG bonds can miss interest payments without any serious consequences but these must be made up at a later date.

While I remain of the view that interest rates will be low for longer, the higher projected yield on the new floating rate bonds discussed in this article provides a good incentive to investors to include the bonds in their portfolio before signs firm of a rise in interest rates.