Key points:

- Rumours of Healthscope Initial Public Offering (IPO)

- Terms of the Notes have a buyback clause which is lower than current trading price – a clear signal to sell

- High yield replacement options

The market for Initial Public Offerings (IPO) has heated up as the year comes to an end on the back of a high priced equity market – the perfect time for Private Equity owners to cash in. Healthscope, currently owned by private equity, has increasingly been rumoured to be considering an IPO and should they undertake such an action, Note holders need to be aware of the “devil in the detail” of what they own.

In December 2010 Healthscope issued a high yield subordinated note (HLNG:AX). Under the terms of the Notes, the issuer has the option to redeem the bonds for a price of $103 from late December 2013. From December 2014 the issuer can redeem at par ($100).

Also contained in the Notes terms is another right of redemption if Healthscope undertakes an IPO. Under this scenario the bond may be redeemed at $102.50 (or the holder can participate in the IPO at a 2.5% discount). Currently the Notes are trading at around $106 “dirty” price. Clearly at this level, the market is not pricing in the redemption risk on the Notes. That is Note holders will receive less than the current market value of the Notes. Investors holding HLNG should look to sell as they are not compensated for the risk of holding them and look to other high yield investments.

The Healthscope Notes II issued earlier this year also has similar IPO redemption clause (again at $102.50 or participating at a 2.5% discount), however this only triggers two years after their issue.

Other options

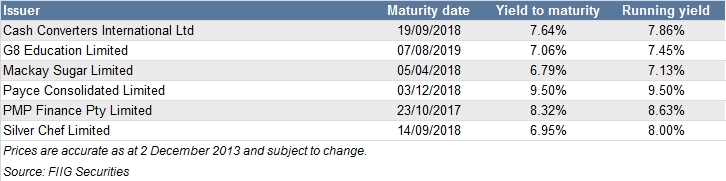

Given Healthscope was a very high yielding bond, investors may be looking for other high yield opportunities. For Wholesale investors the best yielding options all come from the new issue deals FIIG has brought to the market over the last 18 months. Investors moving out of HLNG should consider these high yielding options either as a single bond, or spreading investment across a portfolio of higher yielding bonds. The best yield available for retail clients remains the Sydney Airport inflation linked bonds.

Table 1 contains the current returns available on the FIIG originated deals.

Table 1

Key terms

Dirty price

Is the price of a bond that includes interest accruing and is due for payment on the next coupon payment. Dirty price is also known as gross price.

Running yield

Running yield uses the current price of a bond instead of its face value and represents the return an investor would expect if he or she purchased a bond and held it for a year. It is calculated by dividing the coupon by the market price.

Yield to maturity

The return an investor will receive if they buy a bond and hold the bond to maturity. It is the annualised return based on all coupon payments plus the face value or the market price if it was purchased on a secondary market. Yield to maturity thus includes any gain or loss if the security was purchased at a discount (below face value) or premium (above face value). It refers to the interest or dividends received from a security and is usually expressed annually or semi-annually as a percentage based on the investment’s cost, its current market value or its face value. Bond yields may be quoted either as an absolute rate or as a margin to the interest rate swap rate for the same maturity. It is a useful indicator of value because it allows for direct comparison between different types of securities with various maturities and credit risk. Note that the calculation makes the assumption that all coupon payments can be reinvested at the yield to maturity rate. Also, the yield and coupon are different.