by

Elizabeth Moran | Mar 24, 2015

There is a very wide range of foreign currency bonds available. Yield to maturity in USD bonds range from -0.55% to over 18%. This article considers the risks and well as the probabilities of default for USD bonds using the S&P historic global default table.

Last week we listed the “Top 10 bond risks that you need to know”. This week, we dig down further and assess the risk of default given the credit rating for a range of USD denominated foreign currency bonds.

All of the 10 key risks we listed last week still pertain to foreign currency bonds. But as the name suggests, investors in these bonds also take on foreign currency risk, especially if they need to buy foreign currency to purchase the bonds and then exchange interest income during the term and capital at maturity, back into Australian dollars.

I met a potential new client in Adelaide last week, who had a business in the US and existing USD bank accounts earning very little in the way of interest income. He was a perfect candidate for foreign currency bonds. The risk of changes in the value of the currency would not affect his risk profile as he has an ongoing need for USD. He’d be buying USD denominated bonds for the higher return he could earn for a slight increase in risk and a better return than bank deposits.

FIIG has, over the last six months, suggested wholesale investors consider adding USD bonds to their portfolio as a way to take advantage of an appreciating USD against the Australian dollar. This has for many clients been a rewarding strategy.

However, those that opted to invest in some of the higher risk bonds may have seen an increase in the underlying credit risk of the bond outweigh the currency movements.

It’s a case of determining the level of capital risk you want to take, how reliant you are on the income and which of these is most important.

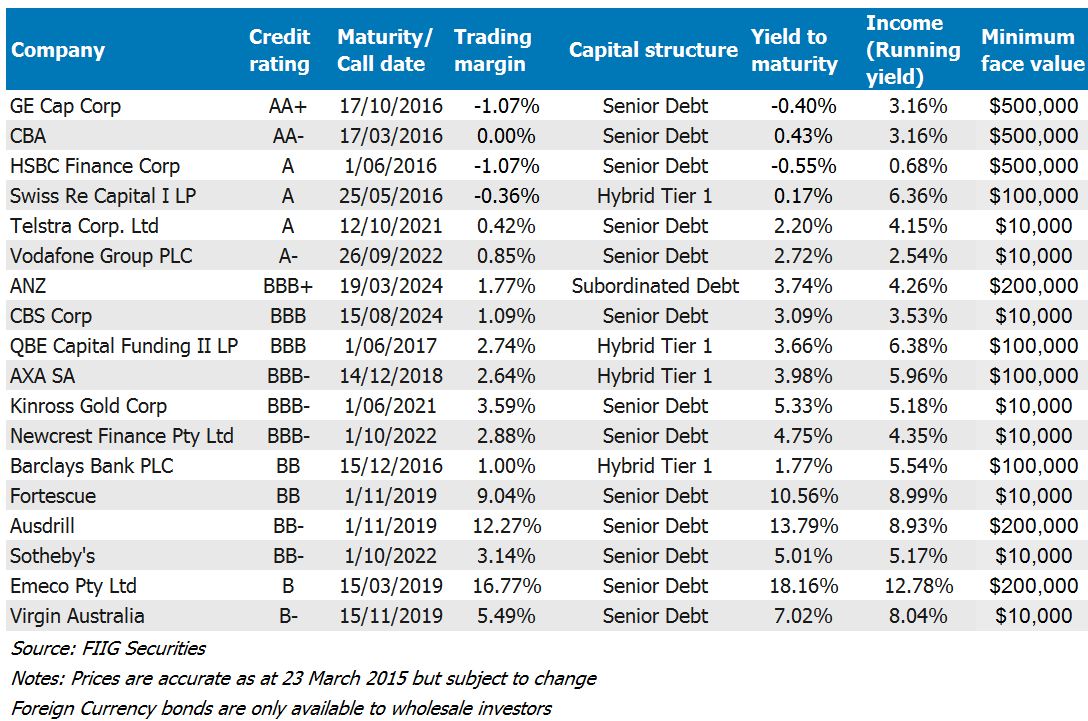

The table below illustrates a range of USD denominated bonds available and minimum investment amounts. I purposely listed the bonds according to their credit rating, with the highest rated bonds at the top moving down to the lowest rated bonds.

Practically all the bonds listed in the table are fixed rate and thus are exposed to duration risk. The exception is the HSBC Finance bond which is floating rate.

The first four bonds are all highly rated and due for maturity in the next 18 months. Three bonds are trading at a negative trading margin (compared to bank swap rates), while the other is at 0.00%. The HSBC and GE Capital Corporation bonds are both trading at negative yields to maturity.

Investors wanting to capture any future USD appreciation but minimise credit risk would look to invest in these bonds. The Telstra and Vodafone bonds, also rated in the “A” range would also be good additions if this was your strategy. Note though, that the Telstra bond is for a six year term with a yield to maturity of 2.20% and the Vodafone, at one notch lower and a year longer pays circa 0.50% more.

Table 1

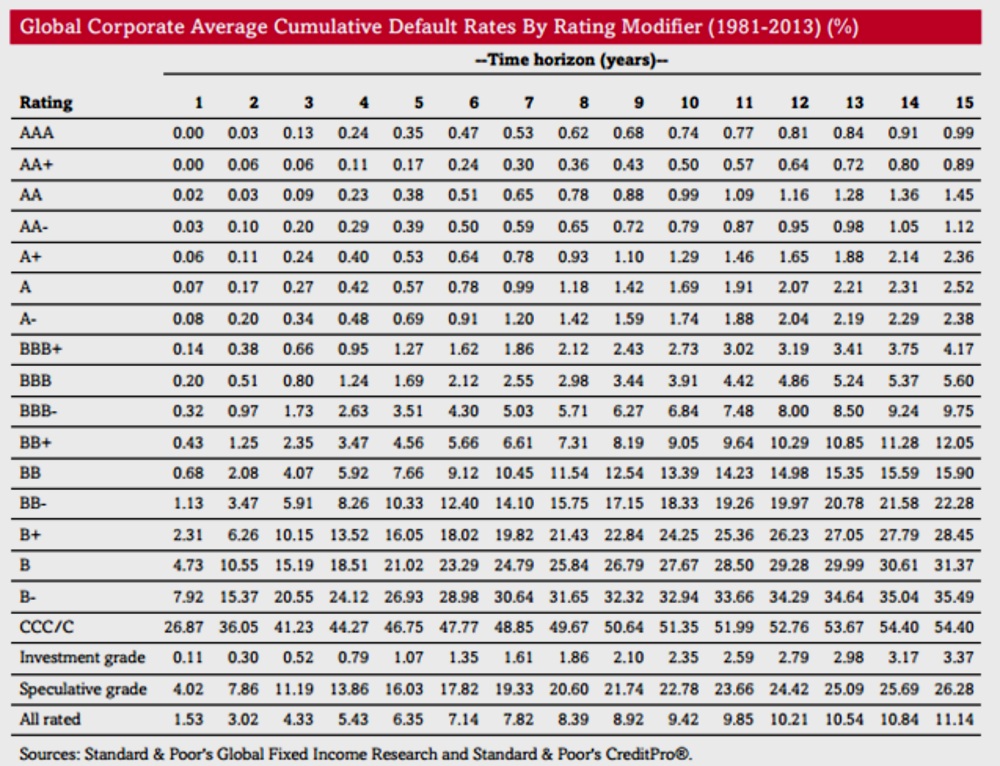

There are six bonds that are rated in the “BBB” range, four in the “BB” range and two in the single “B” range. Risk really starts to increase when bonds are rated sub investment grade (BB+ and lower) and to give you an example we use the S&P Global Corporate Average Default Rates shown in Table 2.

If we consider the CBS Corporation BBB rated bond that matures in nine years in 2024 (so BBB rating line, nine year term) then there is a 3.44% chance CBS would default on the bond in the next nine years. Default means failure to pay interest or principal when it’s due, it doesn’t automatically mean loss.

A default may mean the company goes into wind-up. Assets are sold and proceeds applied to investors given the capital structure. Investors can still recoup capital in a wind-up situation.

Realistically, a poor performing company usually would be downgraded multiple times before default and analysts and investors would be sent warning signals, although there are instances where rated companies default without warning such as in cases of fraud.

If you consider the Barclays Bank and the Fortescue bonds, both rated “BB” but over differing terms, the Barclays bond, rounding up to two years to run has a chance of default of 2.08%, but this jumps to 7.66% for Fortescue, again rounding up to five years. The difference in yield to maturity between the two bonds is significant; 1.77% for Barclays and 10.56% for Fortescue. The question you need to ask yourself is, “Does the yield compensate for the risk involved?”

Assessing the two single “B” bonds, with the Virgin bond being a notch lower than Emeco and eight months longer dated, rounding up for term to maturity, the Emeco risk of default is 18.51% and Virgin is 26.93%. Yet the Emeco bond has a yield to maturity of 18.16% more than double that of Virgin at 7.02%.

Table 2

Clearly anomalies exist in the table.

Credit ratings give an indication of the risk involved, but the credit rating agencies can get it wrong, just as markets can over-react to negative news. Anomalies can provide opportunities. It pays to do as much research you can on the companies that you’re interested in and the industries they operate, to make an informed risk and return decision.

Note: Foreign currency bonds are available to wholesale investors only. For more information please contact your FIIG Representative.

Copyright The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced or distributed to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights.

Disclaimer Certain statements contained in the information may be statements of future expectations and other forward-looking statements. These statements involve subjective judgement and analysis and may be based on third party sources and are subject to significant known and unknown uncertainties, risks and contingencies outside the control of the company which may cause actual results to vary materially from those expressed or implied by these forward looking statements. Forward-looking statements contained in the information regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. Opinions expressed are present opinions only and are subject to change without further notice.

No representation or warranty is given as to the accuracy or completeness of the information contained herein. There is no obligation to update, modify or amend the information or to otherwise notify the recipient if information, opinion, projection, forward-looking statement, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

FIIG shall not have any liability, contingent or otherwise, to any user of the information or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the information. In no event will FIIG be liable for any special, indirect, incidental or consequential damages which may be incurred or experienced on account of the user using information even if it has been advised of the possibility of such damages.

FIIG provides general financial product advice only. As a result, this document, and any information or advice, has been provided by FIIG without taking account of your objectives, financial situation and needs. FIIG’s AFS Licence does not authorise it to give personal advice. Because of this, you should, before acting on any advice from FIIG, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If this document, or any advice, relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a product disclosure statement relating to the product and consider the statement before making any decision about whether to acquire the product. Neither FIIG, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice. FIIG, its staff and related parties earn fees and revenue from dealing in the securities as principal or otherwise and may have an interest in any securities mentioned in this document. Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). FIIG strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. FIIG does not make a market in the securities or products that may be referred to in this document. A copy of FIIG’s current Financial Services Guide is available at www.fiig.com.au/fsg.

An investment in notes or corporate bonds should not be compared to a bank deposit. Notes and corporate bonds have a greater risk of loss of some or all of an investor’s capital when compared to bank deposits. Past performance of any product described on any communication from FIIG is not a reliable indication of future performance. Forecasts contained in this document are predictive in character and based on assumptions such as a 2.5% p.a. assumed rate of inflation, foreign exchange rates or forward interest rate curves generally available at the time and no reliance should be placed on the accuracy of any forecast information. The actual results may differ substantially from the forecasts and are subject to change without further notice. FIIG is not licensed to provide foreign exchange hedging or deal in foreign exchange contracts services. The information in this document is strictly confidential. If you are not the intended recipient of the information contained in this document, you may not disclose or use the information in any way. No liability is accepted for any unauthorised use of the information contained in this document. FIIG is the owner of the copyright material in this document unless otherwise specified.

The FIIG research analyst certifies that any views expressed in this document accurately reflect their views about the companies and financial products referred to in this document and that their remuneration is not directly or indirectly related to the views of the research analyst. This document is not available for distribution outside Australia and New Zealand and may not be passed on to any third party without the prior written consent of FIIG. FIIG, its directors and employees and related parties may have an interest in the company and any securities issued by the company and earn fees or revenue in relation to dealing in those securities.