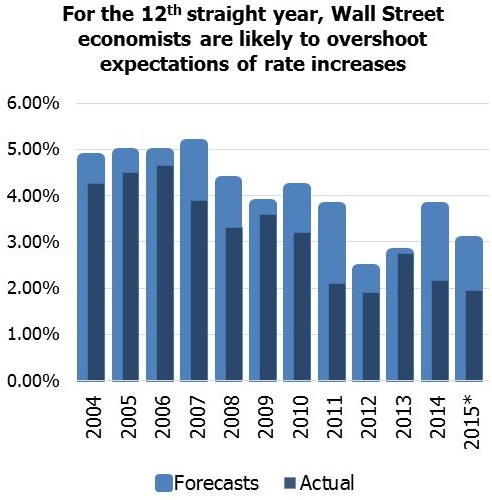

Each year for the past 12 years, Wall Street economists have overestimated the rise in interest rates for that year, as shown in Figure 1. At the start of the year, market expectations were for a 3.0% 10 year bond rate by year’s end. Those expectations have already fallen to 1.93%, as at 20 March 2015.

Source: Bloomberg, FIIG Securities

Figure 1

There is a volume of books that could be written as to why this keeps happening, suffice to say it comes down to over-exuberance. What is important to know though is firstly that this is a human condition that will continue to occur; and secondly how to profit from this.

2015 has provided a great example already. In our 2015 Smart Income Report, we used Figure 1 and a range of fundamental economic trends to predict that US rates would not rise as far as the market was pricing in, and that the USD would continue to rise against the AUD. The way to profit from this trend is to invest in long dated (duration) USD corporate bonds. We also called for more volatility in markets and therefore that investors should diversify across quality corporates.

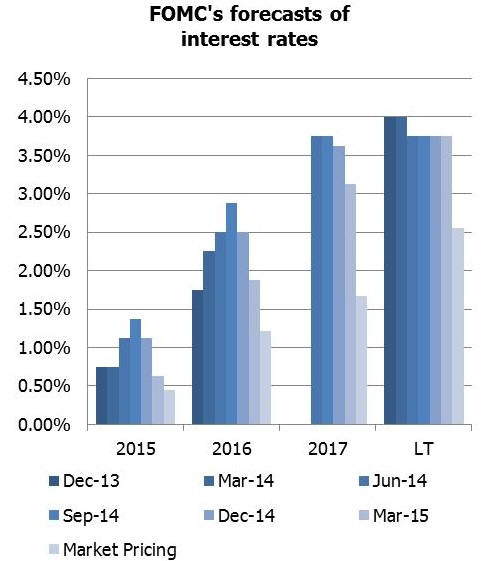

The last week has validated this strategy. The FOMC (the US’s Federal Open Markets Committee, the body responsible for setting US interest rates like our RBA) met last week and shocked markets by lowering their own forecasts of US interest rates in 2015. In fact they lowered them by 50%, from a previous rise in rates forecasted at 1.00% to now just 0.50%.

What is interesting is that markets have now finally accepted that rates will be lower for longer and have lower forecasts than the FOMC (as shown by the “Market Pricing” bars in Figure 2). The question from here is whether the FOMC’s forecasts will continue to adjust downwards as they have since September 2014, or whether the market has overshot and needs to correct?

Source: Bloomberg, FIIG Securities

Figure 2

The answer likely lies in the reaction of markets to the first interest rate rise, or even the market’s expectation of a locked in time for the first rise. The common fear of sensible commentators is that markets have become addicted to low rates, so the first few rises could cause such a shock to equities markets in particular that the Fed will be forced to leave long-term rates lower than in the past.

Market pricing finally reflecting likely long term rates

Markets are finally starting to adjust to the reality that rates will be low in the US for some time to come. So we expect to see further possibilities for gains in long dated bonds in the near future, but recent pricing is approaching fair value. The time to start to rebalance with floating rate notes in the US market is between now and the first rise, likely in September or October this year.

2016 likely to be equally mild – little chance of rapid moves by the Fed

Beyond 2015, the key is inflation. The US Fed has a target of 2% p.a. and doesn’t like inflation to run too far below (or above) this target. At the moment US inflation is running at around 1.6%, although producer price data released in March suggests there is a short term likelihood of this falling slightly. The rising USD and low oil prices, puts downward pressure on inflation. Only wage growth can cause inflation to jump quickly back to 2%, and with the economy’s current pace, wage growth isn’t likely to be an issue until 2016 at the earliest.

More volatility, particularly in equity markets

We also expect to see more volatility as the market’s usual battle between traders and long term investors plays out. The market has no historic data to use this time as there has never been a period of 9 years between tightening (rate raising) cycles. Equity markets have become addicted to low interest rates, so they could fall sharply on any news that hints that rates could rise. Bond markets are less volatile, but this nervousness and lack of historic data to follow will lead to more volatility than usual.

Investment Strategy

Our strategy has changed little since the start of the year. We expected long-term rates in the US to drop and we expected volatility to rise. Clients that have bought into long dated USD corporate bonds like Newcrest 2041 have seen their investments strengthen considerably. For those clients it could be a time to consolidate by diversifying when market volatility creates buying opportunities. For other clients yet to enter this sector, the opportunity is still strong.

The key change to our view is that with the market falling to our expected levels, the next six months is an opportunity to buy into US FRNs. Given that the Australian market tends to follow the US eventually, a similar strategy for AUD FRNs should follow, albeit with less urgency.

Next major market move

As a final note, we recently commented on the likelihood of a decline in credit spreads (the amount of interest paid on bonds above the risk-free rate e.g. government bond interest rate). Now that markets have accepted that rates even in the US will take a long time to rise, investors seeking yield will need to shift from government bonds to corporate bonds. The corporate bond market is finite, so this shift in demand will create an increase in prices, and therefore a decline in the yields offered to new investors. With rising credit quality and the resulting lower default rates, this fall in credit spreads would be justifiable, but investors getting in ahead of this trend would clearly be better positioned. This is a topic we will continue to write about in the coming months.

Copyright The contents of this document are copyright. Other than under the Copyright Act 1968 (Cth), no part of it may be reproduced or distributed to a third party without FIIG’s prior written permission other than to the recipient’s accountants, tax advisors and lawyers for the purpose of the recipient obtaining advice prior to making any investment decision. FIIG asserts all of its intellectual property rights in relation to this document and reserves its rights to prosecute for breaches of those rights.

Disclaimer Certain statements contained in the information may be statements of future expectations and other forward-looking statements. These statements involve subjective judgement and analysis and may be based on third party sources and are subject to significant known and unknown uncertainties, risks and contingencies outside the control of the company which may cause actual results to vary materially from those expressed or implied by these forward looking statements. Forward-looking statements contained in the information regarding past trends or activities should not be taken as a representation that such trends or activities will continue in the future. You should not place undue reliance on forward-looking statements, which speak only as of the date of this report. Opinions expressed are present opinions only and are subject to change without further notice.

No representation or warranty is given as to the accuracy or completeness of the information contained herein. There is no obligation to update, modify or amend the information or to otherwise notify the recipient if information, opinion, projection, forward-looking statement, forecast or estimate set forth herein, changes or subsequently becomes inaccurate.

FIIG shall not have any liability, contingent or otherwise, to any user of the information or to third parties, or any responsibility whatsoever, for the correctness, quality, accuracy, timeliness, pricing, reliability, performance or completeness of the information. In no event will FIIG be liable for any special, indirect, incidental or consequential damages which may be incurred or experienced on account of the user using information even if it has been advised of the possibility of such damages.

FIIG provides general financial product advice only. As a result, this document, and any information or advice, has been provided by FIIG without taking account of your objectives, financial situation and needs. FIIG’s AFS Licence does not authorise it to give personal advice. Because of this, you should, before acting on any advice from FIIG, consider the appropriateness of the advice, having regard to your objectives, financial situation and needs. If this document, or any advice, relates to the acquisition, or possible acquisition, of a particular financial product, you should obtain a product disclosure statement relating to the product and consider the statement before making any decision about whether to acquire the product. Neither FIIG, nor any of its directors, authorised representatives, employees, or agents, makes any representation or warranty as to the reliability, accuracy, or completeness, of this document or any advice. Nor do they accept any liability or responsibility arising in any way (including negligence) for errors in, or omissions from, this document or advice. FIIG, its staff and related parties earn fees and revenue from dealing in the securities as principal or otherwise and may have an interest in any securities mentioned in this document. Any reference to credit ratings of companies, entities or financial products must only be relied upon by a ‘wholesale client’ as that term is defined in section 761G of the Corporations Act 2001 (Cth). FIIG strongly recommends that you seek independent accounting, financial, taxation, and legal advice, tailored to your specific objectives, financial situation or needs, prior to making any investment decision. FIIG does not make a market in the securities or products that may be referred to in this document. A copy of FIIG’s current Financial Services Guide is available at www.fiig.com.au/fsg.

An investment in notes or corporate bonds should not be compared to a bank deposit. Notes and corporate bonds have a greater risk of loss of some or all of an investor’s capital when compared to bank deposits. Past performance of any product described on any communication from FIIG is not a reliable indication of future performance. Forecasts contained in this document are predictive in character and based on assumptions such as a 2.5% p.a. assumed rate of inflation, foreign exchange rates or forward interest rate curves generally available at the time and no reliance should be placed on the accuracy of any forecast information. The actual results may differ substantially from the forecasts and are subject to change without further notice. FIIG is not licensed to provide foreign exchange hedging or deal in foreign exchange contracts services. The information in this document is strictly confidential. If you are not the intended recipient of the information contained in this document, you may not disclose or use the information in any way. No liability is accepted for any unauthorised use of the information contained in this document. FIIG is the owner of the copyright material in this document unless otherwise specified.

The FIIG research analyst certifies that any views expressed in this document accurately reflect their views about the companies and financial products referred to in this document and that their remuneration is not directly or indirectly related to the views of the research analyst. This document is not available for distribution outside Australia and New Zealand and may not be passed on to any third party without the prior written consent of FIIG. FIIG, its directors and employees and related parties may have an interest in the company and any securities issued by the company and earn fees or revenue in relation to dealing in those securities.