The global economy seems to be healing itself slowly. The US economy is coming off the Fed’s life support and recent data has pointed to some very encouraging revival. Chinese growth is moderating. The EU and Japan are underperforming but have stabilised their economies for the meantime.

Risks remain however. The EU and Japan continue to battle with stubbornly low growth and an unhealthy low inflation rate. China’s transition to a self-sustaining economic power is inevitable in the long term, but highly volatile in the short term. The threat of a credit bubble in China, for example, would send global equities into renewed volatility and risk the economic recovery in the US and EU.

For Australian investors, the implications would be particularly severe, given Australia’s perceived reliance upon the Chinese economy. The impact on Australian equities and the AUD could be just as large as that experienced in 2008, and now residential property may well be at risk too.

Flight to safety phenomenon: USD consistently rises in a global crisis

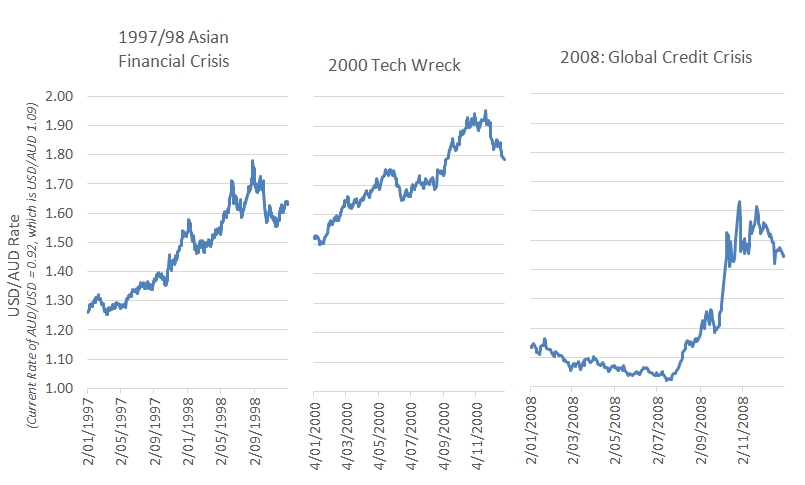

Whether caused by concerns about China or the EU or US, crises inevitably see a flight to the USD and away from growth oriented currencies such as the AUD. Over the past 20 years, major financial crises have seen a trough-to-peak rise in the USD versus the AUD of 42%, 28% and 60% respectively, as shown in Figure 1 (corresponding falls in the AUD: 30%, 22%, 37.5%).

Rise in the USD versus the AUD during global financial crises

Source: Bloomberg

Figure 1

Options for investing in USD

There are two major strategies used by Australian investors to invest in foreign currency, particularly USD:

Options for investing in USD

There are two major strategies used by Australian investors to invest in foreign currency, particularly USD:

1. Direct investment in USD

- Buying spot USD dollars (cash)

Pure USD exposure providing full upside benefits in a crisis. Earn 0-0.25% per annum interest, and pay forex spreads of 0.6%-2%. - Buying USD ETF from BetaShares, earning no interest, paying 40bp per annum management fee but having much lower forex spreads.

- Buying corporate bonds in USD, earning 3-8% per annum, and forex spreads of 0.6%.

Options include lower risk ANZ or WBC bonds at 3-4% per annum, QBE bonds at 4-5%, up to higher credit risk options such as Ausdrill or Newcrest at 7-8%.

2. Unhedged international investments:

- Investing in unhedged international equities funds

This approach reduces the losses from equities in such a crisis, but there will still be losses. USD equity exposures will be largely offset by USD/AUD gains, but US equities only accounts for 40-60% of any international equities exposure. European and Asian currencies will also suffer losses versus the USD in such a crisis, so the net result is likely to be a strong loss. - Investing in unhedged international bond funds or ETFs

Far more effective, as bonds are likely to perform strongly depending upon the nature of the crisis. Yet still suffers from the fact that 40-60% of the currency exposure is non-US, which will fall in a crisis.

Why hedge now? Because wealth management is about wealth preservation too, not just growth

The clearest risk to global financial markets at present is a Chinese “hard landing”. This in turn is most likely to be caused by a credit crisis in China, specifically linked to its property market.

Before we examine this issue more deeply, let’s be clear at the outset, China is not expected to have a “hard landing”. The hard landing scenario, the media and economists refer to, is a slowdown in China’s GDP growth from the current 7.5% per annum to 5.0% per annum or less. The base case that almost all economists believe is that the Chinese slowdown will be gradual.

However, investing is as much about wealth preservation as it is achieving the returns that meet our goals. Wealth preservation is particularly important the older we get as most do not have the flexibility to go back to work to recoup losses. Many Australians learnt this lesson the hard way in 2008.

So, a strong investment strategy will cater for the expected future scenario but will also ensure that in the less likely event of a Chinese hard landing, your savings are not severely impacted.

Conclusion

What is important is that you can weather the storm that would be caused by a slowdown and the best way to do this is to profit from such a scenario. One way to do this is to simply invest in foreign currencies but the interest rates are very low. Alternatively, investing in USD bonds issued by familiar Australian issuers such as the major banks is another effective way to hedge a Chinese hard landing.

And for investors exiting equities altogether because of growing concerns regarding China, a long USD position will enable them to profit from their views and earn a strong yield in the meantime.

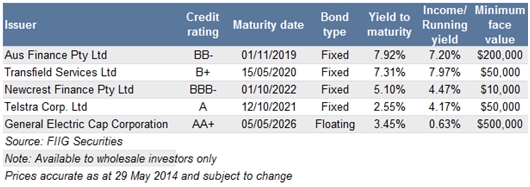

The table below shows a range of risk and return alternatives of some of our favoured USD bonds.

For more information, please call your local dealer.

1 Forex Trading: Online trading platforms enable low margin options for forex traders, but this is typically not suitable for wealth management clients.