by

Elizabeth Moran | Nov 06, 2012

Financial markets are amazing. When I penned the last column, two weeks ago, there were some significant variances between the prices of floating rate notes and fixed rate bonds issued by the same company with the same maturity dates. In just two weeks, the differences have reduced with demand outstripping supply, credit spreads contracting and the price of floating rate notes’ rising.

The sheer size of some of the participants means they can have a lot of influence and can change the dynamics of the market in a short time; something which isn’t obvious, unless you are a broker or highly active investor. We think Australian investors have “seen the light” so to speak as they prepare for a low growth economy with interest rates being lower for longer. This has meant prices for bonds have risen across the board and yields or returns are lower. However, the yields need to be taken in the context of that low growth. Neither, equities or property are likely to outperform under such conditions and investors need to accept the new reality of lower returns on their investments.

The question you need to ask yourself is, “if demand is strong for bonds, why haven’t I taken the opportunity, or do I have enough bonds to sustain my portfolio throughout a low growth environment?

If you’re already invested in direct fixed income you would have witnessed significant gains in the value of your holdings in recent months. That doesn’t mean there still aren’t good value bonds around, they’re just getting harder to find.

The latest buying activity means the future gains and differential I was hoping to show you have largely disappeared.

Still, whether to buy fixed or floating rate securities is a common question and worth explaining how you might chose one over the other.

There are a number of issues to consider:

- What is your view of interest rates? Do you think rates are still likely to contract? Or perhaps will stay low for a few years? Maybe you think rates have hit the low point and will start increasing from here?

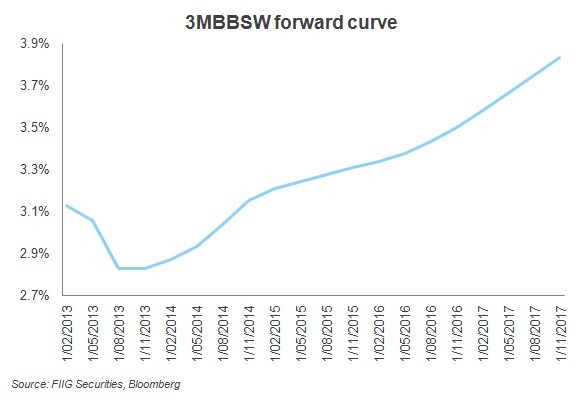

- What’s the market’s perception of interest rates? Does the market perception reflect your own views? The market’s expectations will already be factored into the bank bill swap rate, this is the benchmark rate used to calculate coupon or interest payments on floating rate notes (see Figure 1 below). Forward expectations of 3 month BBSW show low rates, under 3.5% until towards the end of 2016.

Figure 1

- The need for your portfolio to provide a reliable income. If you are near or in retirement, income may be much more important than capital gain at a later point. Equally if income isn’t important you might prefer a capital gain at maturity

- The current weighting of your portfolio. For example my Eureka portfolio is weighted towards fixed rate bonds, so I’m really seeking some floaters to even up the balance

- Other investments you have in your portfolio. We know a lot of SMSFs are heavily weighted to cash in the form of term deposits. Depending on the maturity profile of your TD holdings you may have a preference for either fixed or floating and I’d encourage you to investigate adding some inflation linked bonds as a large, fixed cash holding will mean you are exposed to an inflation rate spike

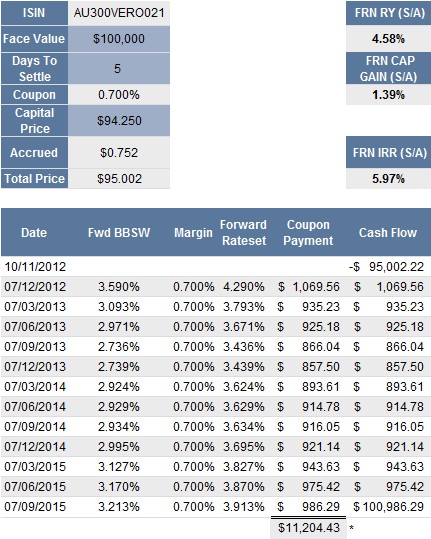

So, let’s compare two bonds; one fixed the other floating for VERO, an insurance subsidiary of Suncorp Metway. Both bonds have the same credit profile and maturity date. Table 1 below shows the expected cashflows for the VERO 2015 floating rate note. It assumes $100,000 is purchased at a discounted price of $94.25. The bond has 0.705 cents in accrued interest, so that the purchase price is $100,000 * (94.250 +0.705) = total consideration of $94,955. The top right hand side column show semi-annual running yield of 4.58% (estimated coupon (interest) payments) and semi-annual capital gain until maturity of 1.38% to take the total estimated semi-annual internal rate of return to 5.96% assuming the bonds are called at the first opportunity.

Note: Both VERO bonds are subordinated debt and as such have a call date of 7 September 2015 when we would expect the bonds to be repaid. However, final maturity is 20 years from issue in September 2025. In common with other insurance bonds, the coupons (interest) payments can be deferred but are cumulative, so must be repaid. The calculations below assume the bonds are repaid at first call and there is no deferral of interest payments.

The columns of the table (reading from left to right) show:

- The coupon payment date. Typically floating rate notes pay quarterly coupons

- Forward estimates of the bank bill swap rate. Notice how it hits a low of 2.727% in September 2013, already factoring in a cut in the cash rate of about 0.50% or 50 basis points

- The margin over BBSW at which the coupon was set at first issue being 0.70%

- The estimated forward interest rate for the particular coupon (this is just the forward BBSW rate plus the margin)

- Estimated coupon or interest payment is $11,205.33 until the first call date

- Cashflows – notice how the first cashflow is negative, this is when you are outlaying for the bond

- From 7 December 2012 this bond pays a quarterly coupon right through to maturity on 7 September 2015, when you would get your final coupon payment plus the $100,000 face value of the bond. So, the majority of the cashflow is at the expected maturity date of 7 September 2015

Source: FIIG Securities

Table 1

In contrast Table 2 shows the cashflows for a VERO 2015 fixed rate bond. The VERO fixed is trading at a premium of $101.50 it has accrued interest of $1.011, so that to purchase $100,000 face value you would need to outlay $102,511. The right hand side columns show a fixed running yield of 6.06% (these coupon (interest) payments are known) and a fixed capital loss of -0.49% until maturity to take the total confirmed rate of return to 5.57%.

A couple of points to note:

- Fixed rate bonds pay half yearly coupons instead of quarterly coupons which are paid on the floating rate notes

- The coupon rate does not change over the expected life of the bond – great for investors looking for an income which they can rely upon

- The coupon payment varies slightly given the number of days in the quarter

- Total coupon payments over the holding period of $18,450 versus $11,205 for the floating rate notes

- Cashflow at expected maturity is the $100,000 face value plus the final coupon payment of $3,100.27, but there is a small loss given the investor pays a premium for the bond upfront

Source: FIIG Securities

Figure 2

I’m a buyer of the floating rate notes as I’m keen to add the upside interest rate protection that this asset will add to my portfolio and the slightly higher return is a bonus. I’m not as concerned with the downside as I think my current fixed rate holding will protect my income. Although I won’t know my exact return until maturity but it could be more if interest rates don’t reach the projected lows of BBSW or they actually increase over the three years.

To summarise, we think yields on all asset classes will be lower for longer. Returns on fixed rate bonds are known and there is a degree of certainty with floating rate notes. Other types of bonds such as inflation linked bonds and inflation indexed annuities are great protective investments for volatile markets. In comparison, investors in equities or property will have uncertain returns and must make the decision to sell to recoup capital; very difficult for investors reliant on income in their retirement.