by

Elizabeth Moran | Sep 24, 2013

Many factors impact bond prices as was demonstrated last week when Bernanke ruled out the near term tapering of quantitative easing. Speculation of the taper based on Bernanke’s earlier comments had tempered markets with the prospect of higher interest rates. Australian 10 year government bond yields declined 18 basis points (bps) (18 bps = 0.18%) to 3.88% last Thursday but regained 8 bps on Friday. Consequently, government bond prices rose, before declining again on Friday (remember that inverse relationship of yield and bond prices for fixed rate bonds).

Other bonds with longer terms to maturity also reacted. For example, the Stockland fixed rate bond maturing November 2020, saw its price rise by $0.62 to $114.50 and its yield to maturity decline 10 basis points to 5.75%. Dalrymple Bay Coal Terminal’s floating rate note with a June 2021 maturity saw its yield to maturity decline by 7 bps to 6.52% although its price moved by just two cents, keeping the bond’s margin over the bank bill swap rate constant at 230 bps.

Over the life of a bond, its price will rise and fall given a multitude of factors. For example a perceived decline in the credit quality of the issuer will see the bond price fall and the yield rise as investors will demand to be paid more for the additional risk of default that the company presents.

The yield offered on new issues of companies with similar credit ratings can influence the existing securities and market supply and demand can also impact pricing.

A fixed rate bond’s price will rise if interest rates decline and vice versa. In that way, fixed rate bonds are an excellent hedge in a declining interest rate environment as their prices will rise, usually offsetting declines in prices of “growth” assets such as shares and property. These price rises offer the opportunity of capital gain if the bonds are sold prior to maturity.

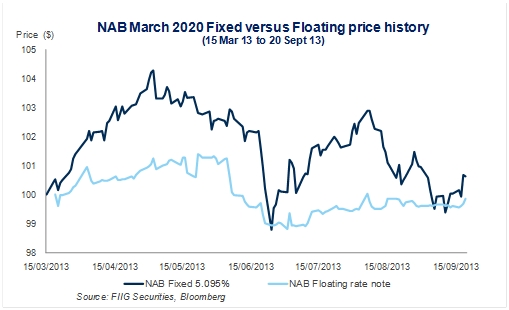

Floating rate note (FRN) prices don’t move as much as their fixed rate cousins, as demonstrated by the National Australia Bank fixed and floating March 2020 issues shown in the graph. FRNs are more capital stable and less affected by changing interest rates as interest is linked to an underlying benchmark, which in Australia is most often the bank bill swap rate (BBSW).

FRN prices move according to:

- Traded margin: The most important factor that will cause fundamental changes to the price of an FRN is the movement in the traded margin or spread over (or under) the benchmark rate. That is the extent to which this margin diverges from the coupon margin. It is a reflection of perceived risk of the issuer; the higher the margin, the higher the risk.

- Short term rate movements: Due to the reset mechanism on the interest payment dates, FRNs will pay a fixed rate until the next interest reset date. Therefore an investor is locked in at the current rate until it resets at the next reset date.

- Long term rate movements: While not as sensitive to long term rate changes as fixed coupon bonds, FRN prices are impacted.