This week we continue our series looking at what happens to debt, Tier 1 hybrids and equity securities when banks fail and require government assistance. Last week, part one looked at the part nationalisation of the big UK bank, Royal Bank of Scotland (RBS). The week we continue with a study of the full nationalisation of another two UK banks: Northern Rock and Bradford & Bingley.

Introduction

During the global financial crisis of 2007-08 many large global banks required assistance from governments in order to prevent greater instability and collapse of the financial system. The UK provides a good case study with Northern Rock and Bradford & Bingley being fully nationalised. The following is a discussion of the events surrounding the nationalisation and the effects on the institution’s securities. The past provides some insight but given the implementation of Basel III and other measures to limit the costs to governments and taxpayers; future bank failures may mean very different outcomes for security holders.

Full nationalisation - A case study of two UK banks: Northern Rock and Bradford & Bingley

Northern Rock and Bradford & Bingley were nationalised in 2008 when the market lost confidence that they could continue to be funded in the private sector. In 2007 Northern Rock was the UK’s 5th largest mortgage lender with £109bn of assets and Bradford and Bingley the 10th largest with assets of £52bn. The UK Treasury arranged for the sale of the retail deposits and branches of Bradford & Bingley to Abbey (part of Banco Santander). By October 2008, the two banks combined, had liabilities including; £36bn of bonds and Tier 1 hybrids and £33bn of Treasury guaranteed deposits.

Treasury was left as the sole owner of three companies:

- A bank intended for return/sale to the private sector – Northern Rock plc

- Two mortgage providers without retail deposits, closed to new business, and with substantial mortgage books in ‘run-down’ – Bradford & Bingley and Northern Rock (Asset Management). These two were integrated in October 2010 under a new holding company, UK Asset Resolution, a subsidiary of the UK Treasury

There were three broad categories of capital in Bradford & Bingley and Northern Rock at the point of their nationalisation: senior debt, subordinated debt & hybrids and equity (mainly shareholder funds).

Equity

- Shareholders were completely wiped out at nationalisation

Senior debt

- Treasury decided not to impose loss on senior debt when the banks were nationalised. It was concerned that eliminating debtholders’ interest in the banks in 2008 would have spread financial instability

- Senior debt interest and principal obligations continue to be met and we expect all senior debtholders to be repaid in full according to the terms and conditions set out in the original investment memoranda

- Senior debt ranks pari passu (equally) with deposits and therefore it is difficult for losses to be imposed without also impacting depositors (unless laws are changed, or senior creditors are subordinated through some form of restructure)

Subordinated debt and Tier 1 hybrids

- Treasury decided not to impose loss on subordinated debt and Tier 1 hybrids when the banks were nationalised. It was concerned that eliminating the debtholders’ interest in the banks in 2008 would have spread financial instability

- Although the securities lost considerable market value, nationalisation resulted in the securities retaining some value so long as taxpayer support kept the banks afloat

- Treasury believed that if the banks were allowed to become insolvent all the capital investors (the shareholders, Tier 1 hybrid and subordinated debtholders) would have lost their full investment and that the banks’ senior creditors would have taken a large loss

- Over the course of 2009 Treasury, in consultation with the European Commission (EC), worked to ensure the appropriate burden sharing between capital investors

- Treasury required the banks not to pay coupons on existing Tier 1 hybrids and subordinated debt nor exercise call options unless there was a legal obligation to do so (as part of EC conditions for state aid). When Bradford & Bingley was nationalised the transfer order modified the rights associated with dated subordinated notes enabling coupons to be deferred. Essentially the UK government changed the terms associated with the notes

- Economic loss (given the suspension of payments) for these security holders was estimated at more than £500m

- The suspension led to a sharp fall in the market value of the affected capital (approximately £2.7bn). In practice this meant payments were deferred whilst senior creditors were repaid

- Payment on some £825m of debt however could not be suspended due to the way it had been issued

- The suspension of payment prevented the payment of dividends to shareholders (the government)

- Redemptions of any capital instruments prior to their final maturity date were subject to obtaining prior consent of the Financial Services Authority (FSA)

The buy back of subordinated debt and Tier 1 hybrids

- At nationalisation the banks had a total of £3.8bn in outstanding subordinated debt and Tier 1 hybrid securities

- Over the course of 2010 the banks bought back £2.4bn of their outstanding subordinated debt for £821m equating to an investor return of 34.2 pence in the pound (or a loss of 65.8%)

- After this, £1.4bn of subordinated debt remained outstanding. Subordinated debtholders, holding £619m did not accept the offer and £825m was not included in the offer (this was the debt mentioned above which could not be included in the payment suspension, and was therefore trading at higher levels. It was considered too expensive to repay)

- After subsequent offers in 2011 minimal original subordinated debt or Tier 1 hybrid securities remained outstanding (excluding the £825m tranche)

- In total, the banks have been able to purchase their own securities at an average 46% discount to face value, generating gains for the bank (but losses to investors) of over £2.1bn

The market price for subordinated debt and Tier 1 hybrids

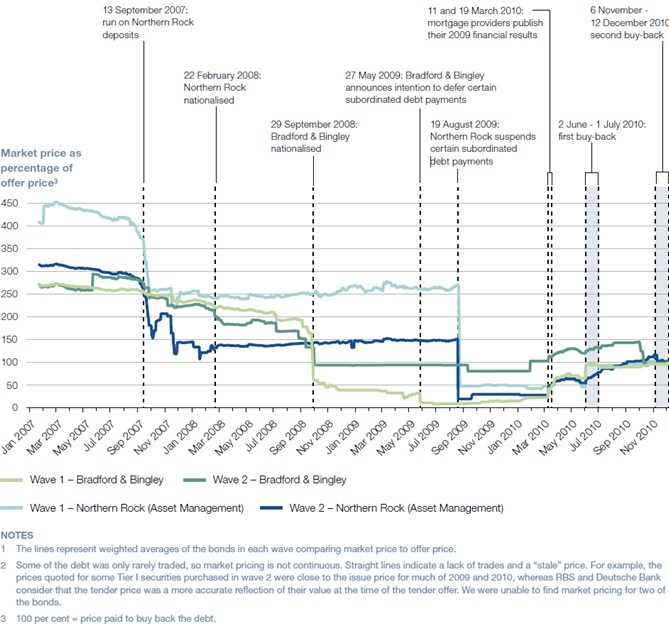

Figure 1 shows the market value of the subordinated debt and Tier 1 hybrids indexed to 100 representing the discounted price paid to buy back the particular securities. For example, wave one for Northern Rock (Asset Management) (as shown by the aqua line) was trading during March 2007 at around 450% (or 4.5 times) of its ultimate buy back price.

- The trading price began falling when markets lost confidence in the banks during July 2007. It fell further on nationalisation, and further still when payment of interest and principal was deferred. The price had started to increase following the publication of the 2009 accounts in March 2010, which improved the markets’ perception of the banks underlying profitability

- The price of the bonds increased further after the announcement in June 2010 of the first buy backs. The bonds’ market price then rose to match the offer price. The remaining bonds increased in value, presumably due to speculation that there would be a second offer

The market value of subordinated debt

Source: UK National Audit Office

Figure 1

Proposed regulation

In September 2011, the UK Independent Commission on Banking (ICB) made recommendations which will have a direct impact on UK bank security holders. These include: “bail-in”, where creditors including senior bondholders are to take a loss relative to their position in the capital structure and deposits are to become preferred (as opposed to ranking equally with senior debt), meaning all other sources of funding must be exhausted before they suffer losses. It is planned that such legislation will be in place by May 2015.

Jump to Part 3 and Part 1