by

Elizabeth Moran | Sep 05, 2012

Alan Kohler asked a great question at the Eureka Congress “What’s the difference between a bank paying a 7% dividend and a 7% bond coupon?” There’s a whole world of difference. First and foremost in most cases the bond coupon (interest) payment is a legal obligation and must be paid (sometimes it can be deferred, but I’ll explain this in more detail later), whereas the dividend is technically a distribution of company profit and there is no obligation for a bank to make a dividend payment.

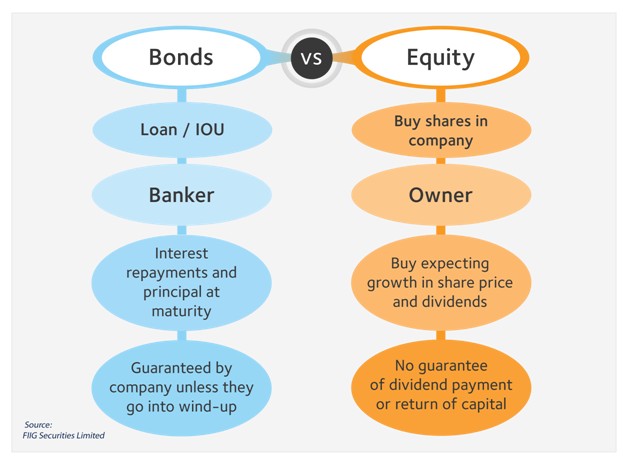

Figure 1 shows a comparison between being a bondholder and being a shareholder. When businesses get big enough instead of borrowing money from banks they can go straight to the market to borrow and raising debt in this way is known as issuing bonds. A bond is a contractual legal agreement, just like a mortgage. The company issuing the bonds sets out when they pay you interest and when capital will be returned to you at maturity. It’s that certainty that makes bonds so attractive. In fact if you are a hold to maturity investor, the only way you wouldn’t get your money back is if the company goes into liquidation or wind-up.

Figure 1

Being a credit analyst at heart, I can’t resist adding that the way to analyse bond and equity/share investment is different. If you’re a bond investor you are interested in the “survivability” of the company, because as long as it survives you’ll get those coupon payments and principal when due. So size counts, bigger companies have more assets to sell and often find it easier to issue more bonds to repay existing commitments. Whereas if you’re a share investor you’re investing with the expectation the company will grow and with that growth, will come a higher share price and a higher dividend. So the drivers for investment are quite different. I tend to think judging if a company will survive is much easier than judging if it will grow.

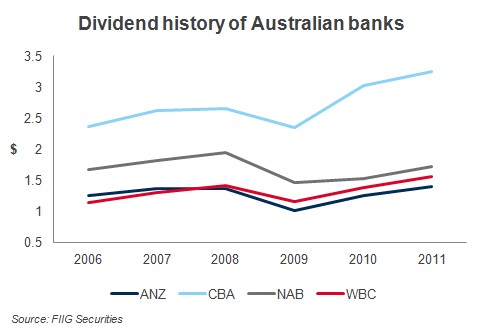

Now usually Australian banks make dividend payments and they often increase them year over year. But during the GFC, all the four majors cut dividends and had you been reliant on that income the lower dividend could have had an impact on your lifestyle (see Figure 2 below).

ANZ cut their annual dividend from $1.36 in 2008 to $1.02 in 2009, a significant 25% decline. NAB cut by a similar percentage, with Westpac cutting by 18.3% and CBA 11.7%. Macquarie cut its dividend by a whopping 46% from $3.45 to $1.85 over the same timeframe. Cutting dividends is expected when times are difficult and the banks did exactly the right thing at the right time. What most investors don’t realise, is that cutting dividends is protective of bondholders as funds remain in the bank to ensure that bond commitments, which are legal obligations, are paid when due.

Figure 2

Usually the dividends combined with the franking (although not all investors enjoy franking benefits) will offer a greater return than the coupon on a bond. Franking of a 7% dividend will equate to a return of approximately 10%, the sort of return investors should expect to receive for an equity investment. Franking works differently with listed hybrid coupons. If you own listed hybrids you would prefer to receive unfranked dividends, this just means you get the whole of the distribution up front and don’t have to wait until tax time to claim back the franking component. If a 7% listed hybrid coupon is franked then you would only receive a lower distribution and have to wait until you put in your tax claim at a later date to receive the full amount.

Do you know why dividends payments are generally higher than bond coupons?

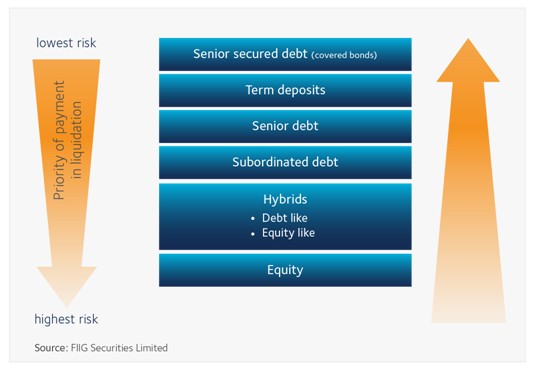

If you answered that it is all to do with the risk involved, well done, you are correct. Bonds are lower risk than shares, so generally pay lower returns. Figure 3 shows a simplified bank capital structure. This diagram shows the priority of payments should the bank go into wind-up. If that was the case receivers would come in and start selling down assets. Investors at the top of the structure, the covered bond holders, would be paid first and once they are paid in full, then the term deposit holders would be repaid, and so on. Actually, in order to issue covered bonds, banks need to set aside 8% of their mortgage loan portfolio and this pool is used exclusively to repay the covered bonds should the bank go into wind-up. Only when they have been repaid in full, can funds be distributed to investors lower in the structure.

Term deposits are still government guaranteed to $250,000 and are a very safe investment, but this guarantee sits outside of a bank’s capital structure. Then moving through the levels, senior debt (senior bonds sit at this level), then subordinated debt (subordinated bonds) which is just junior to senior debt, then hybrids and most risky in the capital structure is equity or shares.

Figure 3

Senior bank debt is a very low risk investment. Generally in Australia, senior debt is issued for five years and at maturity the $100 face value of the bond is returned to you. Depending on whether you hold fixed rate bonds or floating rate notes the coupon will be paid semi-annually or quarterly respectively.

As you move lower into subordinated debt and hybrids the terms and conditions of the securities change. The banks want to borrow for longer periods to meet regulatory requirements but investors only want to lend for shorter periods. So, for the banks to satisfy the regulators and issue subordinated debt, they lend for periods of say 10 years but provide an implied agreement to repay at first call (usually after 5 years). So if you have subordinated bank bonds, they should pay a higher return as you have what is known as “call risk” and that is that the bonds won’t be repaid at the implied maturity and maturity could be extended another five years to be 10 years in total.

Hybrids are the most complex fixed income investments. Just about every prospectus I’ve read has different terms and conditions and I’d urge you to get hold of a copy to try and determine the risks involved. At FIIG, we’ve started to classify hybrids as either “debt-like” or “equity-like”. New bank hybrids issued this year have clauses which mean they can revert to equity in a wind-up. So while the circa 8.25% coupon looks attractive, in effect investors are taking on equity risk where we would expect target returns to be between 10% and 12%. Putting on my analyst hat tells me this isn’t a good risk/ return trade-off.

Equity is most risky in that if a bank or a corporate goes into liquidation, that is can no longer pay principal and interest on its debt obligations, equity or shareholders are in the first loss position. In other words losses are applied from the bottom up.

The capital structure is very important as investors would expect higher returns for investments that sit lower in the capital structure as they are higher risk. Equity or shareholders would expect the shares they own to deliver higher returns than term deposits and senior debt. In this way fixed income securities are always lower risk than shares (although there are some hybrids which convert to equity in a wind-up scenario as mentioned above).

So, if you hold shares you should expect to earn the highest return in the capital structure. But this isn’t always the case. Since the GFC, equity investment has been volatile and in the last 12 months until 30 June 2012, the ASX200 returned -7% (see article “What’s your return?”).

Going back to my credit analyst days, what I’m searching for in the capital structure is where the returns given the risk, don’t make sense, providing investors with higher compensation or return for the risk involved.

In summary, if you can find a bank that pays the same coupon on their bonds as dividend, I’d opt for the bond every time. You’d hold a lower risk security offering the same return (excluding franking) with a defined maturity, where you’ll get your capital returned to you and there is no need to make a decision to sell.