by

Elizabeth Moran | Nov 11, 2013

Key points:

- If you don’t have any bonds we would suggest you start by buying one fixed rate, one floating rate and one inflation linked bond, then weight your portfolio given your view of future interest rates.

- Current opportunities exist in fixed rate bonds in the five to seven year maturity bucket and include: G8 Education, Qantas and Mirvac.

Property and shares are widely held growth investments in Australia and most investors hold cash as their defence against shocks to their portfolio. The problem with this asset allocation is that it doesn’t contain bonds which have defensive qualities that neither cash nor shares nor property provide.

So, before I delve a bit more into the timing of entry into bonds I’d like to briefly convey the importance of bonds and why every investor needs an allocation to bonds.

Fixed rate bonds provide a hedge against interest rates. When the economy begins to decline and growth slows or turns negative, the Reserve Bank would counteract by cutting official cash rates to stimulate growth. In a declining economic environment, shares and property typically underperform. Unemployment rises and spending declines as consumers are cautious. As interest rates decline, fixed rate bond prices rise and can exceed the $100 value on first issue, outperforming when traditional growth assets underperform. Fixed rate bonds thus act to smooth portfolio returns.

Floating rate bonds and inflation linked bonds are preferable when interest rates have hit the low point in the cycle. Interest payments on the floating rate bonds will rise as interest rates rise as they are linked to a benchmark.

Inflation linked bonds provide the only direct 100 per cent hedge against inflation as the value of capital is tied to the Consumer Price Index (and interest is based on the growing capital value, so is also protected against inflation).

These are some of the benefits that bonds provide and cash does not.

Some commentators report that now isn’t a good time to get into bonds, but when you compare the alternatives given the low rate environment, term deposit returns are very low and everything else looks expensive. The normal risk premium has been squeezed and there’s only a small premium available, meaning investors are not being paid for taking additional risk. This is a characteristic of a low interest rate environment. Across all markets, investors have chased high yield and high demand has increased prices and reduced potential returns. The obvious question is “How long will the low interest rate environment last?”

Timing the market is difficult as I think there are always opportunities in any market at any given time.

Of 27 economists surveyed by Bloomberg the median view of the cash rate for 2014 is unchanged at 2.5 per cent. The bank bill swap rate curve (a proxy for the banks’ forward expectation of interest rates) suggests banks expect rates will remain low for the next five years. The bank bill swap rate curve then rises steeply and there are a number of fixed rate bonds in the five to seven year bracket, priced on the curve, that provide good relative value returns (see Table 1).

All the bonds are senior and fixed rate. The Sydney Airport 2020 bond is an inflation linked bond that I’d add to the list with an estimated yield to maturity of 6.80% assuming inflation of 2.50% (the RBA mid target point).

Table 1

If you don’t own any bonds, I’d suggest you start by purchasing at least one fixed rate, floating rate and inflation linked bond. Then, depending on your need for a known income and your expectation of interest rates, I’d weight the portfolio accordingly.

Most investors don’t appreciate that bonds have two elements: known interest payments and the fact that bond prices change creating an opportunity for higher (and lower) returns. Bond returns were significant in the 2012 calendar year and many individual bonds in the wholesale market had returns in excess of 20 per cent. Very high returns are made by investing in fixed rate bonds at the top of the interest rate cycle.

As interest rates are close to their low point, we wouldn’t expect these very high returns in the next few years.

While now isn’t the “best time” to invest in bonds, the protections that bonds offer are unique and as such every investor should have an allocation to bonds.

Key terms

Capital price

Is the price of a coupon bond that does not include any accrued interest. Capital price is also known as clean price, meaning ‘clean of, or excluding, coupon’.

Face value

Is the initial capital value of the bond and the amount repaid to the bondholder on its maturity, usually $100.

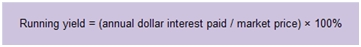

Running yield

Running yield uses the current price of a bond instead of its face value and represents the return an investor would expect if he or she purchased a bond and held it for a year. It is calculated by dividing the coupon by the market price.

Trading margin

The expected return earned on a floating rate security in addition to that security’s reference rate. Also known as the ‘Discount Margin’.

Yield to maturity

The return an investor will receive if they buy a bond and hold the bond to maturity. It is the annualised return based on all coupon payments plus the face value or the market price if it was purchased on a secondary market. Yield to maturity thus includes any gain or loss if the security was purchased at a discount (below face value) or premium (above face value). It refers to the interest or dividends received from a security and is usually expressed annually or semi-annually as a percentage based on the investment’s cost, its current market value or its face value. Bond yields may be quoted either as an absolute rate or as a margin to the interest rate swap rate for the same maturity. It is a useful indicator of value because it allows for direct comparison between different types of securities with various maturities and credit risk. Note that the calculation makes the assumption that all coupon payments can be reinvested at the yield to maturity rate. Also, the yield and coupon are different.