by

Dr Stephen J Nash | Oct 31, 2012

Did you know there are two main types of inflation linked bonds? This article looks at the two main formats, capital indexed bonds and inflation indexed annuity bonds and suggests that the indexed annuity bonds deserve more attention.

While the most prominent form of ILBs is the capital indexed bonds (CIB), the inflation indexed annuity bonds (IIA) is worth considering for a number of reasons. While both cover the central investment risk of inflation, for those investors needing to fund spending in retirement, the IIA is the better choice, while the accumulation phase is probably better served by the CIB.

CIB cashflow

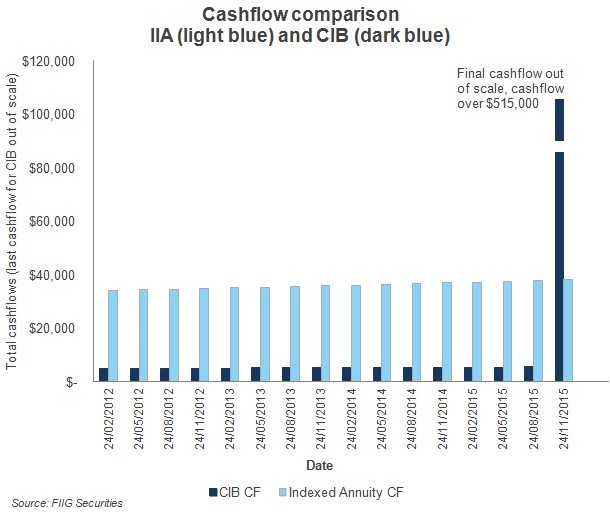

With CIB, the cashflow, where principal and interest are indexed to inflation, is effectively “trapped” in the bond, and pays out at the maturity date, leaving very little cash for the funding of ongoing expenditure in retirement (1) Hence, the CIB is very much suited to the “accumulation” phase of investment, where the superannuation fund will not need to fund recurrent expenditure. In Figure 1 we chart the CIB cashflows, for a three year CIB, shown as the dark blue columns, for a bond of $500,000 face value, an issue yield of 4% real (or above inflation), and a semi-annual coupon of 4%. Please note that the last payment is out of scale, as it is over $515,000. If we did not change the scale of the last payment, all the other cashflows become somewhat “microscopic”.

Another interesting aspect of the CIB is that it tends to increase the exposure of the investor, to the issuer, over time, as the issuer must pay out the adjusted capital price, not the face value, at maturity.

IIA cashflow

With the IIA, the cashflow is effectively “released”, where the principal and interest, which are both indexed to inflation, are paid out over the life of the security. Just as a mortgage usually has a little principal and a little interest, so too does an IIA, where the uniform monthly payment stream has some interest and some principal, so that there is no large payment that is due at the maturity of the bond. This format of payment is much better for retirees, who need to fund regular payments and allows them a better way of managing ongoing expenses. In Figure 1, the annuity payments are shown as the light blue bars.

Notice how the IIA has much larger, and more even cashflows, while the CIB cashflow grows over time but has one large payout at maturity (2).

Figure 1

Another interesting aspect of the IIA is that it tends to decreases the exposure of the investor, to the issuer, over time, as the issuer pays out principal over the term of the bond.

Average semi-annual spending

We can see that the annuity has the more even cashflows, but let’s compare the two ILB formats for a retiree with regular spending patterns. In order to estimate average weekly expenditure, or spending “basket”, we refer to the Australian Securities and Investment Commission (ASIC) website, who estimate that average spending in the average household in New South Wales is around $1,265 per week (Source: https://www.moneysmart.gov.au/managing-my-money/budgeting/spending/australian-spending-habits). Such weekly spending equates to roughly $65,780 per year, or $32,890 per half year. Given this spending, we index that spending to inflation each half yearly period, and then compare it to the cashflows provided in Figure 1 above. We represent this analysis in Figure 2 below.

Before you run for the hills, the analysis is quite straightforward. In Figure 2 the dark blue line represents the difference between the cashflow of the semi annual spending amounts and the CIB, while the light blue line charts the IIA and the semi annual spending amounts, as estimated by ASIC.

- First, notice the different scales, where the left hand side is much larger than the right hand side, meaning that the CIB cashflows differ from the spending basket much more, by around $30,000 per half year, compared to the IIA, which almost matches the spending

- Second, that last cashflow, at the end of the CIB, is again out of scale, and again would be much larger than represented below

- Third, the CIB cashflow does not assist with the funding of the spending basket, while the IIA does very well, given the much smaller variance of the IIA cashflow less expenditures, when compared to the CIB cashflows less expenditures

Figure 2

Conclusion

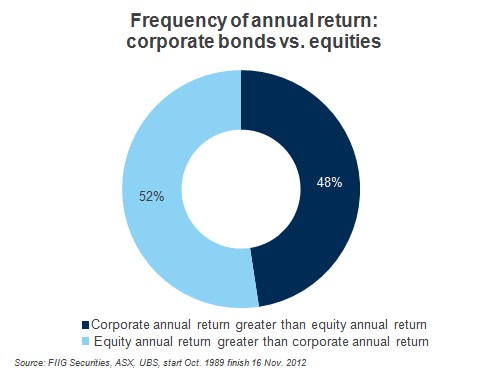

ILBs have a bright future in the Australian market, and the recent uptick in headline CPI has already flowed through to a large increase in the adjusted capital price. This article has tried to show the large differences that exist between the CIB and the IIA format of inflation linked bonds. While the IIA suits those in retirement, and compares very well with other annuity products offered in the market by private providers, the CIB suits the younger investor, who is still in the accumulation phase of investment.

Companies that issue IIAs include: Praeco, Progress Health and Southbank. Returns on these securities currently provide returns of over 3.5% real, or above inflation.

For more information, please call your local dealer.

(1) As you know, the adjusted capital price is the price that the ILB adjusts to when the inflation index is released. Hence, when the inflation information is released by the Australian Bureau of Statistics (ABS), the amount owed by the issuer, to the investor goes up. For example, using a very simplified example, if a CIB had a coupon of 4% at the start of the year, and inflation was 3%, then the issuer would owe you 103, not 100, at the end the year. Also, the coupon would be increased to around 4.12%, or 4% times 1.03; 100+3%.

(2) Another interesting aspect of the IIA is that it tends to decreases the exposure of the investor, to the issuer, over time, as the issuer pays out principal over the term of the bond.