Making regular investments of smaller sums of money is an effective way to achieve a financial goal without feeling daunted by the task ahead. It can also keep you on track so you can reach your goal faster.

Set and forget!

Setting up automatic investments is an easy way to ensure you contribute monthly whilst removing the pressure of deciding when to make each investment.

Not only do automatic investments simplify the process, it also discourages risky investment behaviour such as market timing or following the crowd.

Dollar-cost averaging

Automatic investments of the same amount of money each time is also a great way to implement the 'dollar-cost averaging' strategy, and in many ways, simply replicate what your super contributions are doing but with the advantage that the money can be accessed for personal goals.

The unit price of the Fund will fluctuate as markets rise and fall, which means the investments you have will have been purchased at different prices because they were bought at different times.

Dollar-cost averaging benefits:

- Buying fewer assets when prices are high and more when they're low.

- Lowering the average entry cost into specific assets over time.

- Encouraging discipline in investing.

- Removing behavioural biases and emotional factors.

Emotional investing risks:

- Dangerous reliance on emotional instincts.

- Vulnerability to market cycles, especially during volatility.

- Potential for panic-selling during market dips.

- Overweighting in specific asset classes during market booms.

- Detrimental impact on long-term investment goals.

Regular Investing in practice

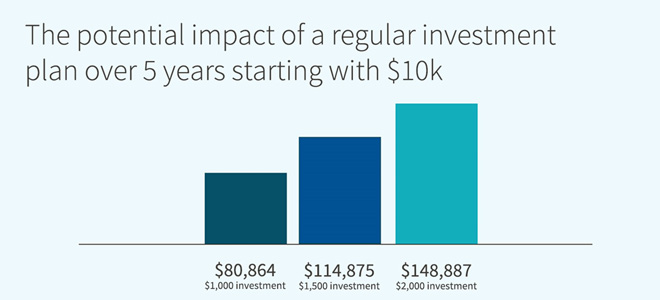

Below is an example of how regular investing can build up investment balances over time, assuming you have $10,000 to start with, set monthly contributions over a 5-year period and achieve a 5% average annual return, including distributions.

By investing $1,000 a month, your investment could look like the below chart. Starting with a balance of $10,000, after 5 years of monthly contributions and a 5% average annual return, your balance would be approximately $80,464 for a $1,000 monthly contribution and $114,875 for a $1,500 monthly contribution.

Please note: These financial projections are for illustration only and not financial advice. Results can vary due to market fluctuations and individual circumstances and the projections assumes distributions are reinvested and does not take into consideration buy/sell spreads. Past performance doesn't guarantee future results. Consult a financial advisor before making investment decisions. No warranties or representations are made about accuracy or completeness. Tailor financial decisions to your situation and objectives.

How to set up a Regular Investment Plan

Setting up an Auto Invest plan is simple and only takes a few minutes by completing the Regular Investment Plan section through the online portal on the InvestorServe. Simply navigate to the “Payment Instructions” and then “Savings Plan” section. Then follow the prompts to add or amend your Regular Investment (Savings) Plan.

For new applications there is a Regular Investment Plan section in the online join form to provide the amount and bank account for the Regular Investment Plan.

Can I edit or pause my Regular Investment Plan?

Yes, they can be modified or cancelled through the online InvestorServe portal.

What happens to my Auto Invest on weekends and public holidays?

Direct Debits are processed on the 15th of each month. If this date falls on either a weekend or a public holiday, your Auto Invest transaction will be carried over to the following business day.

What is a regular investment plan?

A regular investment plan allows you to commence investing into the Fund with as little as $1,000 on a monthly basis. The key advantage is that it removes the need to manually make investments, eliminating the need of organising for additional applications and ensuring you stay committed to your financial goals.

For more on the FIIG Australian Bond Fund, please visit the dedicated microsite by clicking here.