by

Philip Brown, Head of Research | Aug 27, 2024

“There was a little girl, who had a little curl, right in the middle of her forehead. When she was good, she was very, very good, but when she was bad, she was horrid.”

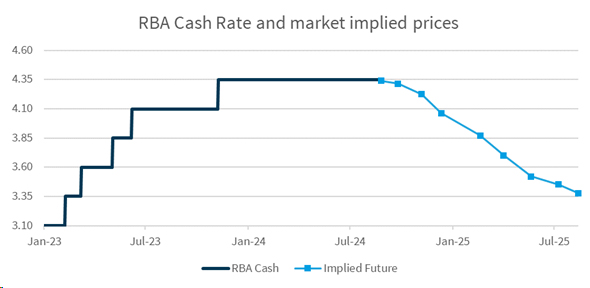

If you believe the markets, RBA rate cuts are in the air and possibly coming imminently. Yet the RBA is still refusing to rule out further rate hikes. The disconnect looks strange – but it’s an artifact of the difference between the most likely outcome (no rate cuts) and the weighted average of possible outcomes (which is pulled lower by the tail risk of a hard economic landing and a significant rate cut cycle). The disconnect also affects how different forms of investments behave. When the RBA is expected to cut rates, the interest rates received for investing in Term Deposits can drop quickly, and this has happened in Australia over the last couple of months.

The underlying cause of the significant drop in Term Deposit rates is that market pricing currently suggests that the RBA rate in February 2025 will be 3.87%, or in other words, nearly a 50bp reduction in the cash rate from now until early next year. A simple (perhaps simplistic) read of the market pricing is that the market expects two rate cuts.

These two expected rate cuts reverberate around the market, and in particular, are felt in much lower Term Deposit rates at major banks. After all, if the RBA is expected to cut rates, Term Deposits should reflect the expected path of the RBA.

Source: FIIG Securities, Bloomberg

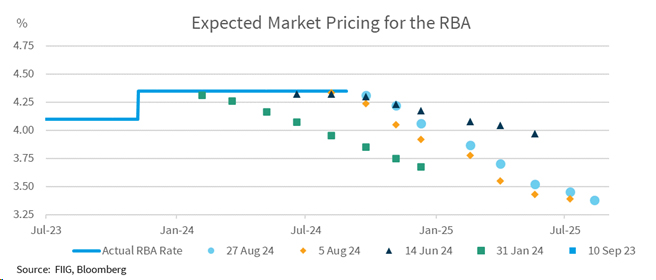

But the market is often wrong about the expected path of the RBA – and wrong in predictable ways. Most of the time, the priced cuts do not eventuate. So why would the market consistently price rate cuts that do not happen? Because when the cuts do come, the cycle can be very large. So a good outcome is a solid economy (a very, very good situation) and no rate cuts in the near term, but a bad outcome is a hard landing and a horrid economy. In which case, the RBA could well slash rates by 200bp.

However, the market pricing of 50bp of cuts is not a simple expectation of 50bp of cuts. It’s the weighted average expectation of all the different things that might happen – a residual chance of a rate rise, some chance of no cuts, a larger chance of a small number of cuts, and a very small chance of a very large number of cuts. Although the tail risk is not likely, it has an outsized effect on the pricing of the RBA. Even if the few expect the RBA to follow the implied pricing, the risk of a hard landing means the average expected rate is much lower than the median (or most likely) rate.

Once we get to this point in the cycle, the tail risk of a hard landing for the economy will always be there, so the market will very likely price rate cuts until the coming rate cut cycle is fully complete – which may well be 18 months or more into the future.

For example, the RBA has frequently faced market pricing of rate cuts over the last 12 months which have not been delivered.

Unfortunately, Term Deposits are the worst of both worlds for investors at this point. They have low yields – often lower than the cash rate. If the more likely result of little change to the cash rate eventuates and pricing meanders along at current levels for months, like the RBA expects, then Term Deposits will be unattractive for a long period. However, if things in the economy go bad, there’s little to be gained from a short-term investment in a Term Deposit, since Term Deposits won’t make a gain in that scenario either.

What’s a better solution? Let’s instead look at longer-term bonds, like five-year or ten-year. These longer bonds currently have yields well over Term Deposits, even for safe, investment-grade options. For example, Transurban Queensland recently issued a ten-year, investment-grade bond with a yield of 5.623% at the pricing date. The bond yields are higher because the bonds look over the cycle, not just at the next few months, but also because they involve credit. In a safe environment where not much happens, investors happily receive a yield well above Term Deposits while the market waits for the RBA to get around to cutting rates. In a difficult environment, the duration in the ten-year bond makes for a very good investment that is likely to rise strongly.

Bond prices work inversely to yields, so if the RBA cut rates materially there will still be a decent fall in yields and a rise in bond prices.

It’s this combination of a solid ongoing return in most of the stable scenarios and the ability for bond investments to outperform in a difficult environment that makes bonds superior to Term Deposits as we approach the turning point from the RBA. From here, Term Deposits are likely to remain unattractive options for a prolonged period. Bonds, which have the benefit of higher yields and duration to protect against downturns, are likely to be the better investment for this part of the economic cycle and into the RBA cuts – whenever they eventually get around to it.

Please be aware that there are some other key differences between bonds and term deposits, including corporate bonds having a higher level of risk of loss of investment capital. For more on the differences between the two financial products please click here